(Zero Hedge)—The world now teeters dangerously close to a major military conflict. This brewing storm of global unrest in Eastern Europe, the Middle East, and the South China Sea signals a chilling reminder of the world on fire.

The shift towards a multipolar world has led to a surge in military spending by countries. New data from the Financial Times reveals that the world’s top defense firms have been bombarded with orders from tanks to fighter jets to missiles.

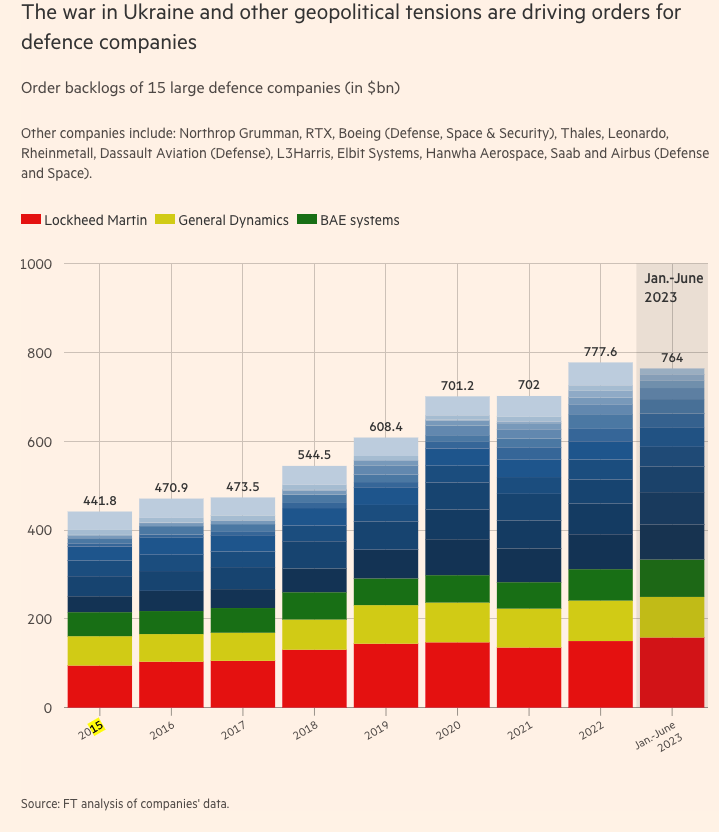

Britain’s BAE Systems, South Korea’s Hanwha Aerospace, and the United State’s Lockheed Martin, along with twelve other defense firms, were found to have combined order backlogs of $777.6 billion at the end of 2022, up from $701.2 billion two years earlier – or about a 10% increase.

During the first half of 2023, the combined backlogs for the top 15 defense companies reached $765 billion, driven by surging war risk in Ukraine and the South China Sea, which forced governments to continue placing orders. The explosion of a possible regional conflict in the Middle East will likely result in surging orders in 2024.

According to the Stockholm International Peace Research Institute, total global military spending increased 3.7% in real terms in 2022 to a new record high of $2.24 trillion.

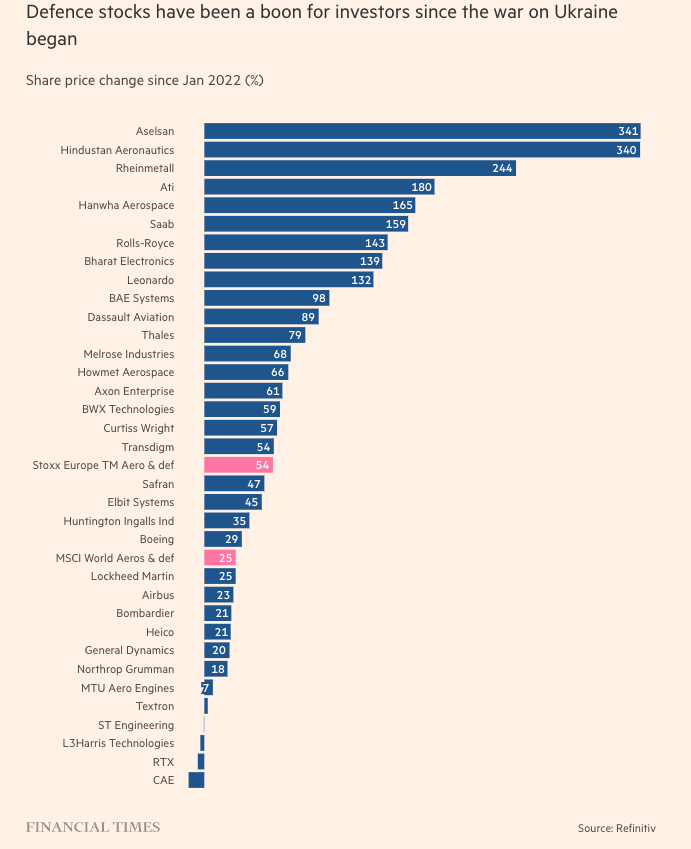

Defense stocks have soared as war risk surges. MSCI’s global defense benchmark is up 14% on the year and breaking out to new highs.

A breakdown of individual defense firms on a year-over-year price change since January 2022 shows monster gains across the board.

“The reality is lead times for policymaking, budgets and placing orders are so long that the invasion of almost two years ago is only just appearing in orders and barely in revenues, except for a few shorter-cycle specialists such as Rheinmetall,” Nick Cunningham, analyst at Agency Partners, said.

The order pipeline for defense firms will remain robust as the realities of a multipolar world continue to emerge.

It’s becoming increasingly clear that fiat currencies across the globe, including the U.S. Dollar, are under attack. Paper money is losing its value, translating into insane inflation and less value in our life’s savings.

Genesis Gold Group believes physical precious metals are an amazing option for those seeking to move their wealth or retirement to higher ground. Whether Central Bank Digital Currencies replace current fiat currencies or not, precious metals are poised to retain or even increase in value. This is why central banks and mega-asset managers like BlackRock are moving much of their holdings to precious metals.

As a Christian company, Genesis Gold Group has maintained a perfect 5 out of 5 rating with the Better Business Bureau. Their faith-driven values allow them to help Americans protect their life’s savings without the gimmicks used by most precious metals companies. Reach out to them today to see how they can streamline the rollover or transfer of your current and previous retirement accounts.

Trump would end every threat of war. He would just tell China, Russia and Iran,:”If you think your economies are bad now, wait till you start a war”. End of conflict on day one.

The arms industry singing “Happy days are here again, happy days are here again…”