(Visual Capitalist)—For much of the last year, recession fears have been building against a sharp rise in interest rates and market uncertainty.

Only recently has there been a shift in sentiment. Given the resilience of the U.S. economy, a growing amount of investors are seeing an increasing likelihood of a soft landing—where the Federal Reserve raises interest rates to combat inflation without triggering a recession. However, many still remain cautious.

Don’t just survive — THRIVE! Prepper All-Naturals has freeze-dried steaks for long-term storage. Don’t wait for food shortages to get worse. Stock up today. Use promo code “jdr” at checkout for 35% off!

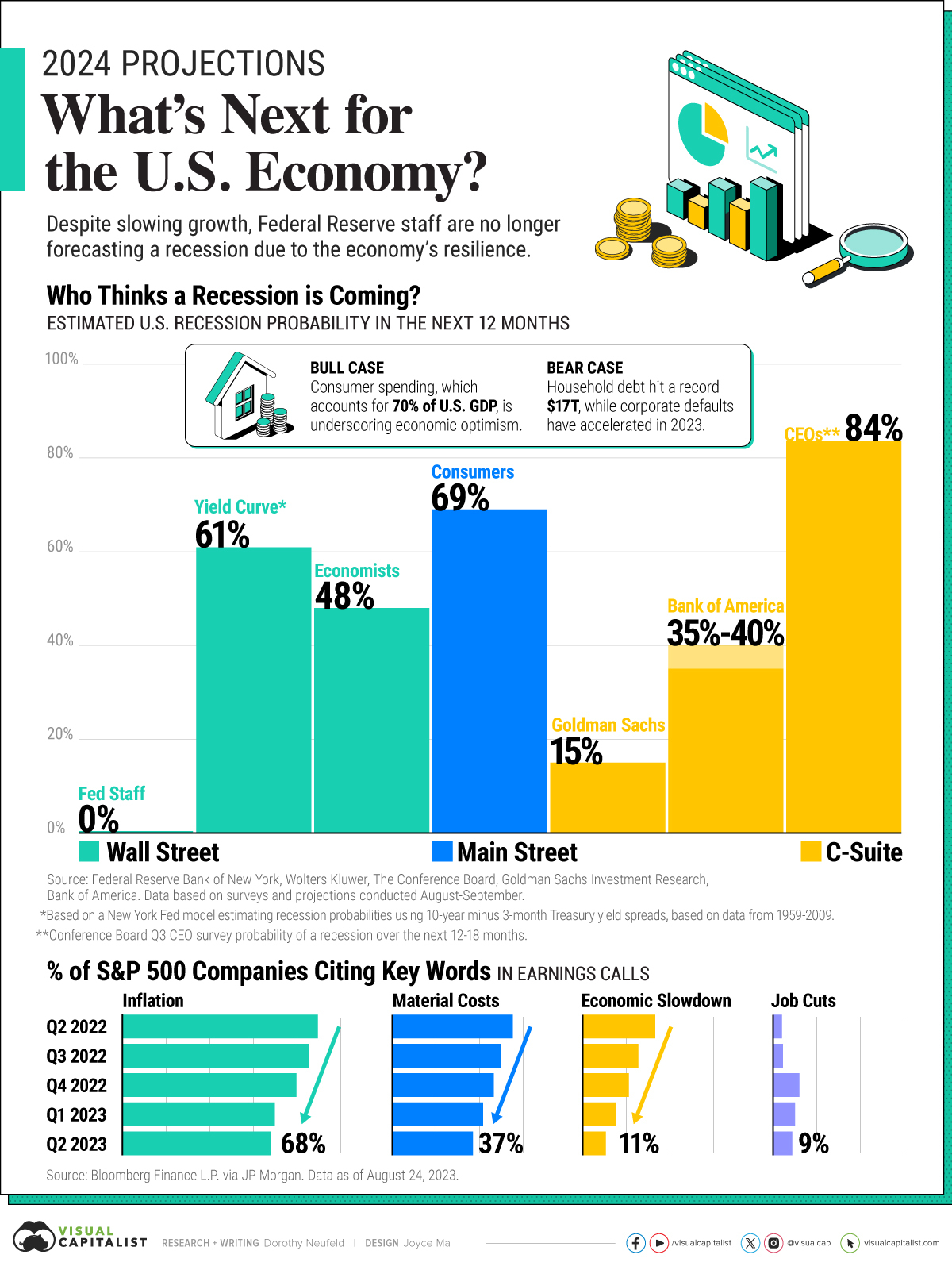

This graphic shows U.S. economic forecasts across Wall Street, Main Street, and C-Suite for 2024.

The Probability of a Recession in 2024

In July, the Federal Reserve staff announced that they were no longer forecasting a recession in 2024, marking a sharp departure from earlier projections.

While the Fed staff continue to share a brighter outlook, the yield curve spread between 10-year and 3-month Treasury rates suggests there is a 61% change of a recession in the 12 months ahead. Historically, the yield curve has been a reliable predictor of recessions, based on a New York Fed model which uses data from 1959-2009.

Meanwhile, a survey of economists by Wolters Kluwer shows that they’re split, with 48% calling for a recession over the next 12 months.

Across Main Street, consumers share a more cautious sentiment, with over 69% saying that a recession is likely in the next year, based on a Conference Board survey.

Yet corners of America’s C-suite have grown more positive. Goldman Sachs recently dropped its recession forecast to a 15% likelihood while Bank of America gives it a 35-40% odds. On the other hand, 84% of CEOs are preparing for a recession in the next 12-18 months, a drop from 92% seen in the second quarter of 2023.

Bull Case vs. Bear Case Signals

Among the key factors investors are closely watching center around the impact of higher interest rates on the economy.

For the bull case, higher rates appear as though they haven’t significantly impacted consumer spending yet, although spending has slowed on non-essential items. Retail sales continue to be solid, and earnings across Home Depot, Walmart, Lowe’s, and other major retailers show resilience. Where the main changes are occurring are with consumers purchasing more affordable options.

However, consumers are relying increasingly on borrowing for spending.

For the bear case scenario, household debt has hit record highs of $17 trillion in March, rising 19% year-over-year. Higher rates have led these borrowing costs to jump, likely affecting household budgets. Meanwhile, corporate defaults have accelerated in 2023, and are projected to keep rising.

Overall, there are mixed signals across the wider economy, and it’s unclear if the country will experience or avoid a recession in 2024. Quantifying the full effects of higher interest rates on consumers and businesses remains an open question.