(The Epoch Times)—The Supreme Court ruled unanimously in favor of the IRS on June 6 in a dispute over tax on shareholders’ life insurance policies.

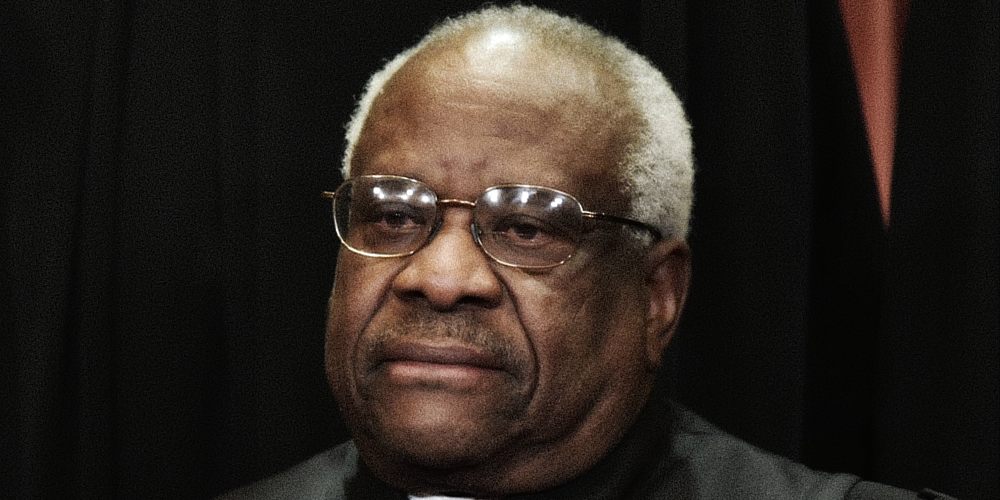

Justice Clarence Thomas wrote the court’s 9–0 decision in Connelly v. Internal Revenue Service. The case concerns two brothers’ closely-held corporation. After one of the brothers died, tax authorities and the estate did not agree on the value of the stock.

Closely-held corporations commonly enter into agreements that require the redemption of a shareholder’s stock after the shareholder dies to preserve the closely held nature of the business. Under such routine estate-planning devices, corporations that enter into such agreements purchase life insurance on the shareholder to make sure the transaction is funded.

The Supreme Court held that life insurance proceeds that will be used to redeem a decedent’s shares must be included when calculating the value of those shares for purposes of the federal estate tax.

The appeal of Thomas Connelly, executor of the estate of the late Michael Connelly, was rejected by the U.S. Court of Appeals for the 8th Circuit in June 2023.

The IRS said the estate owed close to $1 million after it found that St. Louis-based Crown C Corporation, a building materials business, failed to report life insurance proceeds after Michael Connelly died in 2013.

Michael Connelly, who was president and CEO of the corporation when he died, owned 77.18 percent of the company’s shares, while Thomas Connelly owned 22.82 percent.

The executor filed an estate tax return reporting the value of his late brother’s shares as $3 million, but the IRS conducted an audit in which an accounting firm valued the shares at more than $3.8 million at the time of the brother’s death.

The IRS determined that the life insurance proceeds needed to be included in the valuation of the corporation, which meant the company had a value of $6.8 million at the date of death. The IRS found that the estate owed an additional $890,000. The estate paid the amount and then sued the tax agency in federal court in Missouri.

The Supreme Court examined whether a life insurance policy obtained to finance the company’s repurchase of the late co-owner’s shares should be factored into the valuation of the stock.

Don’t just survive — THRIVE! Prepper All-Naturals has freeze-dried steaks for long-term storage. Don’t wait for food shortages to get worse. Stock up today. Use promo code “jdr” at checkout for 25% off!

The estate argued the stock should not be taxed because the proceeds were to be used to repurchase the outstanding shares. The IRS countered that the shares were subject to tax based on the fair market value as measured by what they could be sold for when the co-owner died.

The case concerns an important question of federal tax law on which the federal courts of appeal disagree, according to the surviving brother’s petition.

Under the Internal Revenue Code, when an individual dies that person’s estate is subject to federal estate tax calculated based on the fair market value of the estate’s holdings at the time of the death.

“In many cases, fair market value can be determined through a straightforward analysis of public markets. But when a particular type of asset is not freely traded, fair market value must be determined on the basis of assessment and evaluation,” the petition states.

Don’t wait for a stock market crash, dedollarization, or CBDCs before securing your retirement with physical precious metals. Genesis Gold Group can help.

“Under applicable Treasury regulations, life-insurance proceeds payable to a corporation may be relevant to determining the value of a decedent’s stock in the corporation in some circumstances but not others.”

“The question presented is whether the proceeds of a life-insurance policy taken out by a closely held corporation on a shareholder in order to facilitate the redemption of the shareholder’s stock should be considered a corporate asset when calculating the value of the shareholder’s shares for purposes of the federal estate tax.”

In his new opinion, Justice Thomas recounted that the Connelly brothers entered into an agreement to make sure the company would stay in the family if either brother passed away. In that pact, the corporation could be forced to purchase the deceased brother’s shares.

To finance this possible share redemption, the corporation took out life insurance on each brother. After Michael Connelly died, there was a dispute over how to value his shares for calculating the estate tax.

“The central question is whether the corporation’s obligation to redeem Michael’s shares was a liability that decreased the value of those shares. We conclude that it was not and therefore affirm” the decision of the 8th Circuit, Justice Thomas wrote.

The justice explained that when Michael Connelly died, the corporation was worth almost $4 million and the family valued his shares at about $3 million. But the tax agency took the view that the corporation’s value was closer to $7 million because of the $3 million in insurance proceeds. This made the decedent’s shares worth a little over $5 million.

“Because a fair-market value redemption has no effect on any shareholder’s economic interest, no willing buyer would have treated [the] obligation to redeem … as a factor that reduced the value of those shares,” Justice Thomas wrote.

Crown C Corporation’s “contractual obligation to redeem Michael’s shares did not diminish the value of those shares.

“[R]edemption obligations are not necessarily liabilities that reduce a corporation’s value for purposes of the federal estate tax[,]” the justice wrote for the court.

What Would You Do If Pharmacies Couldn’t Provide You With Crucial Medications or Antibiotics?

The medication supply chain from China and India is more fragile than ever since Covid. The US is not equipped to handle our pharmaceutical needs. We’ve already seen shortages with antibiotics and other medications in recent months and pharmaceutical challenges are becoming more frequent today.

Our partners at Jase Medical offer a simple solution for Americans to be prepared in case things go south. Their “Jase Case” gives Americans emergency antibiotics they can store away while their “Jase Daily” offers a wide array of prescription drugs to treat the ailments most common to Americans.

They do this through a process that embraces medical freedom. Their secure online form allows board-certified physicians to prescribe the needed drugs. They are then delivered directly to the customer from their pharmacy network. The physicians are available to answer treatment related questions.

Then the law sucks!!!