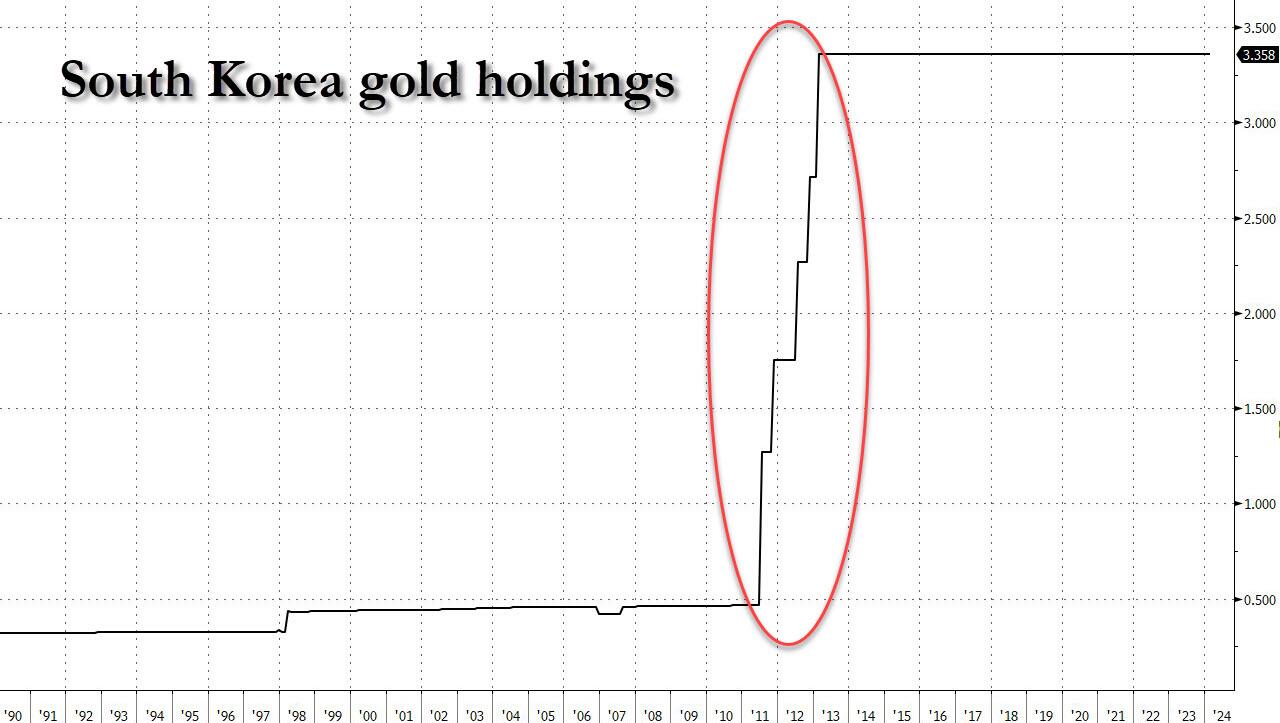

(Zero Hedge)—Back in 2011, around the time gold hits its previous cycle high, South Korea surprised the fiat world when it revealed that it had spent more than a billion dollars in its first gold purchase in more than a decade, as uncertainty about global growth and sovereign debt push central banks around the world to diversify foreign reserves. It then proceeds to buy a lot more gold (relatively speaking) for the next year and a half before halting purchases indefinitely once again in 2013. It now holds 104.4 tonnes of gold in its foreign exchange reserves, or $4.8 billion, accounting for 1.1% of its total $419.3 billion in reserves at the end of March.

That may change soon, however, because with gold hitting a new all time high in recent weeks, South Korea’s central bank may consider buying more gold in the mid- to long-term, even if it is not thinking of immediately buying more after a recent surge in prices of the precious metal, a bank official said on Tuesday.

The bank’s rare comments come after this month’s record high of $2,431.29 an ounce in spot gold as growing Middle East tension drove investors to seek safe-haven assets. The metal has risen 13% this year, building on a gain of 13% in 2023.

“We don’t have any immediate plans to buy gold now,” Kwon Min-soo, head of the Bank of Korea’s reserve management group told Reuters, adding that numerous factors needed to be weighed to ensure the right circumstances for such purchases.

“Foreign exchange reserves must be on a sufficiently increasing trend, and the foreign exchange market must be stable in order to ‘consider’ purchasing additional gold as an asset, which is why we would consider them only in the mid- to long-term,” he said.

Translation: South Korea will buy more gold, but only after spot prices have jumped another several hundred dollars.

Important: Our sponsors at Jase are now offering emergency preparedness subscription medications on top of the long-term storage antibiotics they offer. Use promo code “Rucker10” at checkout!

In a blog post earlier, the bank’s Reserve Management Group said it needed to be cautious when investing in gold, but advantages offered by the precious metal included its role as a hedge against inflation and an alternative to the US dollar.

Recent gains in gold prices were due mostly to purchases by central banks of countries such as China, Russia and Turkey, which are trying to become less dependent on the US currency or guard against war, the bank said.

The thaw in sentiment toward gold is a reversal from the BOK’s June 2023 position when the central bank said it was more desirable to maintain dollar liquidity than boost its gold holdings, after its first inspection of gold holdings at the Bank of England.

It’s becoming increasingly clear that fiat currencies across the globe, including the U.S. Dollar, are under attack. Paper money is losing its value, translating into insane inflation and less value in our life’s savings.

Genesis Gold Group believes physical precious metals are an amazing option for those seeking to move their wealth or retirement to higher ground. Whether Central Bank Digital Currencies replace current fiat currencies or not, precious metals are poised to retain or even increase in value. This is why central banks and mega-asset managers like BlackRock are moving much of their holdings to precious metals.

As a Christian company, Genesis Gold Group has maintained a perfect 5 out of 5 rating with the Better Business Bureau. Their faith-driven values allow them to help Americans protect their life’s savings without the gimmicks used by most precious metals companies. Reach out to them today to see how they can streamline the rollover or transfer of your current and previous retirement accounts.