(Zero Hedge)—Silver demand continues to surge, driven by technologies like solar power and AI.

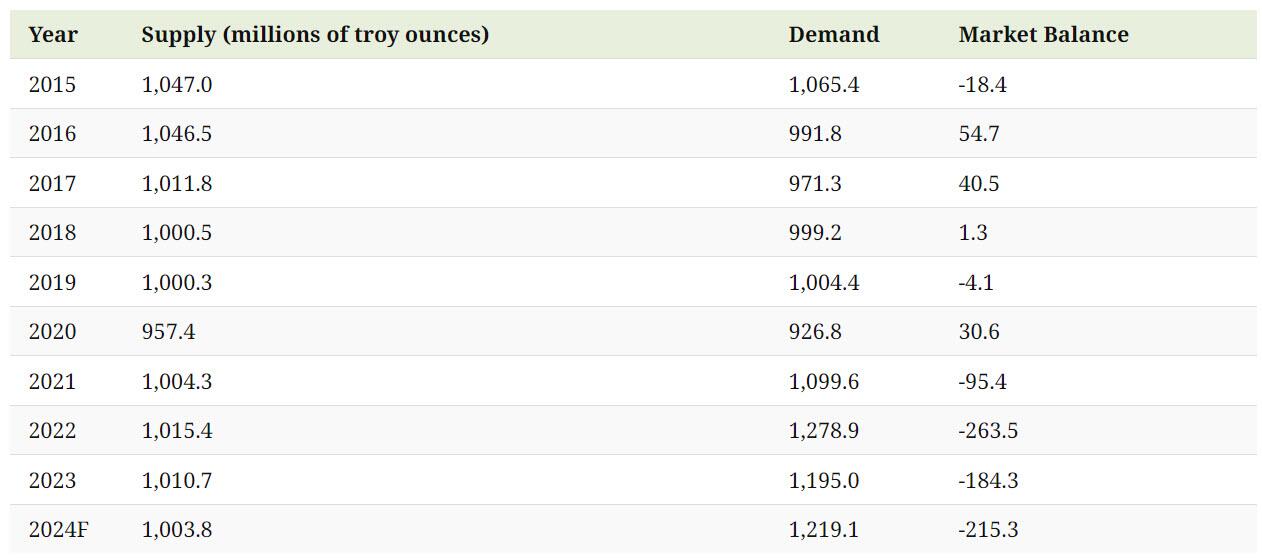

In 2023 alone, the silver market experienced a 15% supply deficit. Furthermore, the market is expected to reach a cumulative deficit of 1,093.4 million ounces from 2020 to 2024.

In this graphic by Outcrop Silver, Visual Capitalist’s Bruno Venditti discusses how new mines are necessary to meet the high demand for the metal.

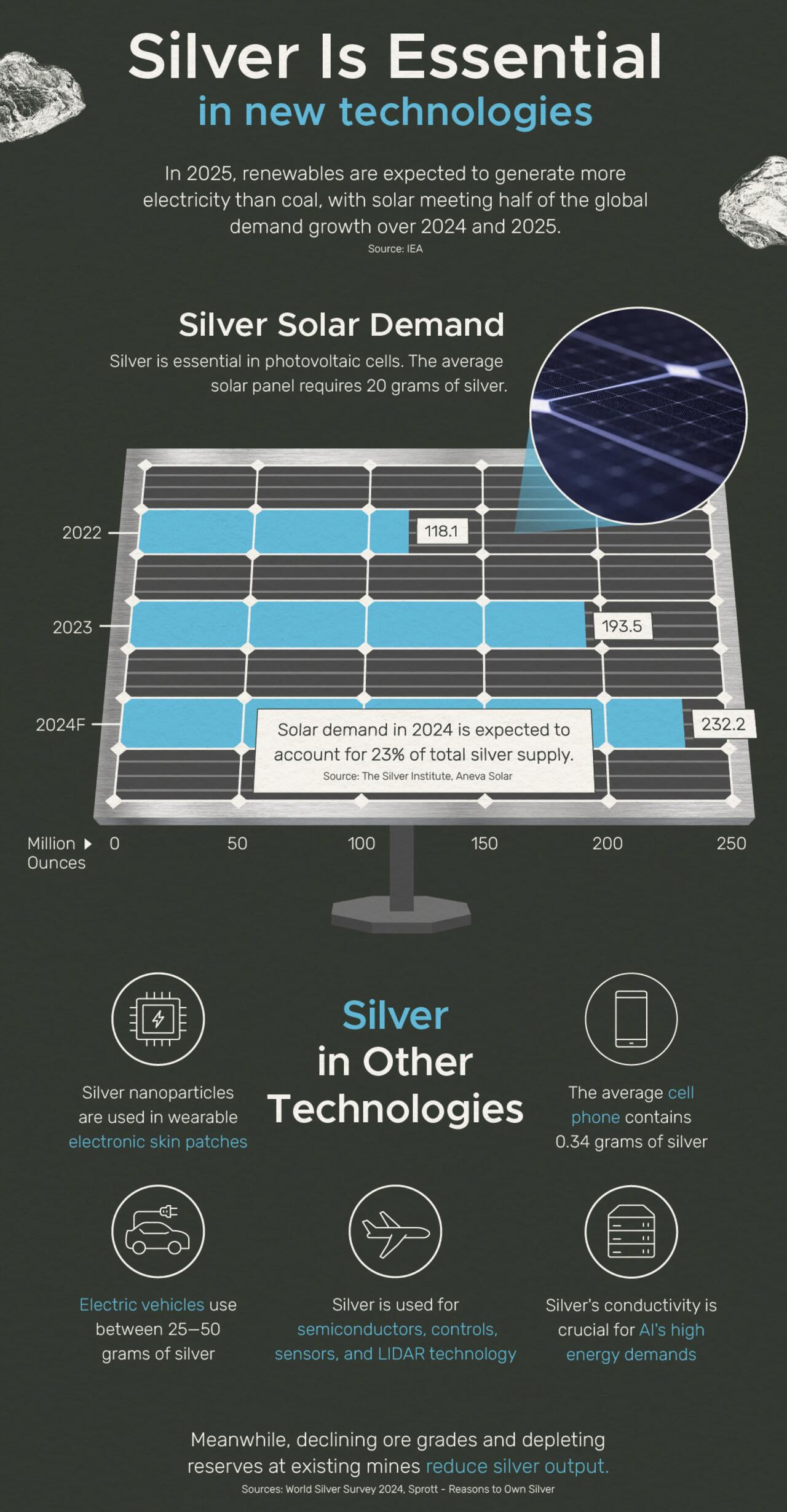

Silver is Essential for New Technologies

According to Sprott, Silver is second only to oil as one of the most widely used commodities, with more than 10,000 applications worldwide.

The metal is a key component in photovoltaic cells used in solar power. The average solar panel requires 20 grams of silver.

Electric vehicles also use between 25 and 50 grams of silver.

In addition, the metal is essential for semiconductors, controls, sensors, and LIDAR technology in AI-enabled transport. Silver is also critical in healthcare AI, through conductive silver nanoparticles in wearable electronic skin patches.

The average cell phone contains 0.34 grams of silver.

The Risk of a Supply Gap

Despite silver’s importance, declining ore grades and depleting reserves at existing mines are reducing the metal output.

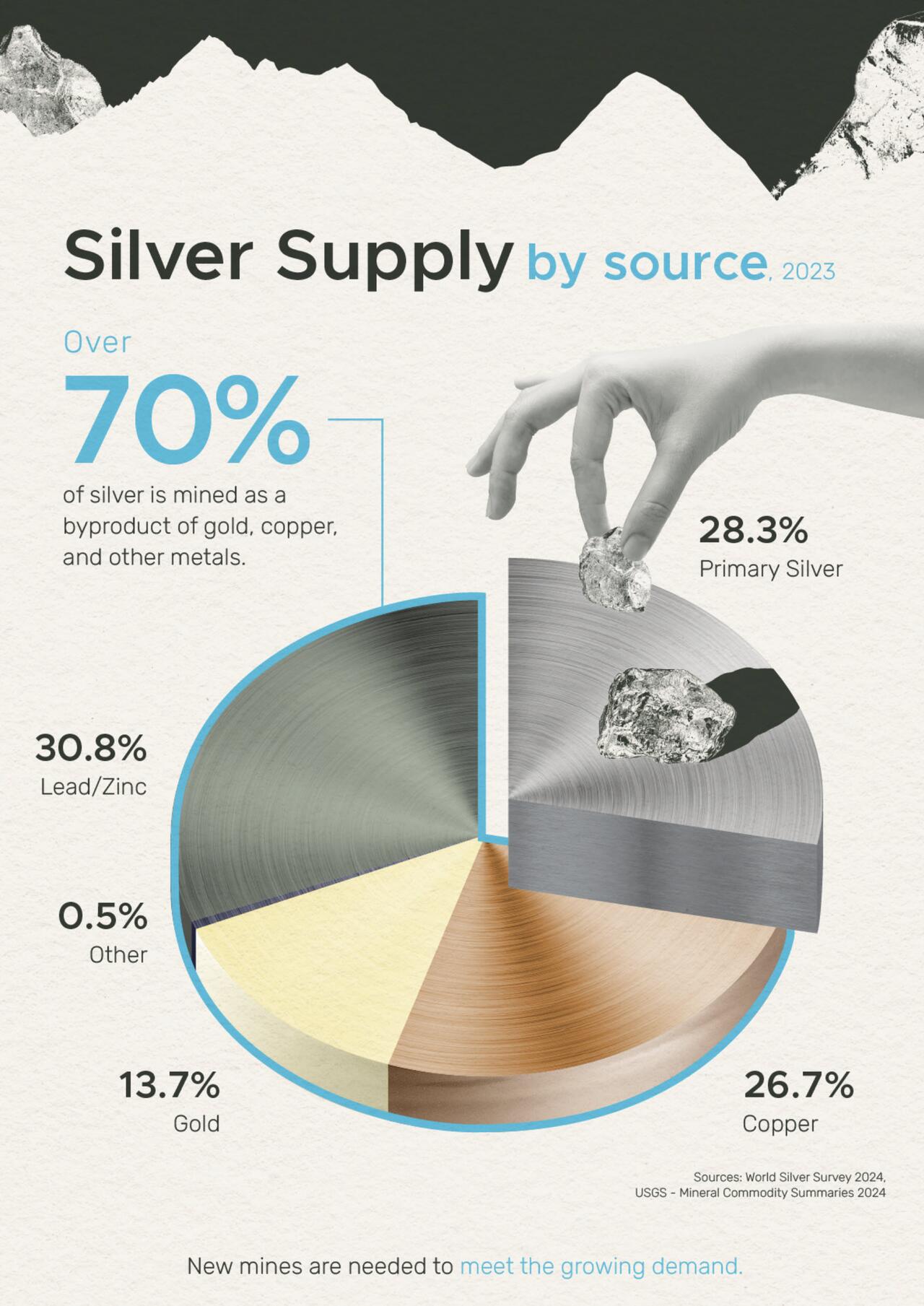

The industry also suffers from a lack of investment in primary silver mines. Today, over 70% of silver is mined as a byproduct of gold, copper, and other metals.

Don’t just survive — THRIVE! Prepper All-Naturals has freeze-dried steaks for long-term storage. Don’t wait for food shortages to get worse. Stock up today. Use promo code “jdr” at checkout for 25% off!

Production is also concentrated in three countries—Mexico, Peru, and China—which together account for half of global silver production.

The Future of Silver

If current circumstances continue, new mines will be necessary to meet the growing demand.

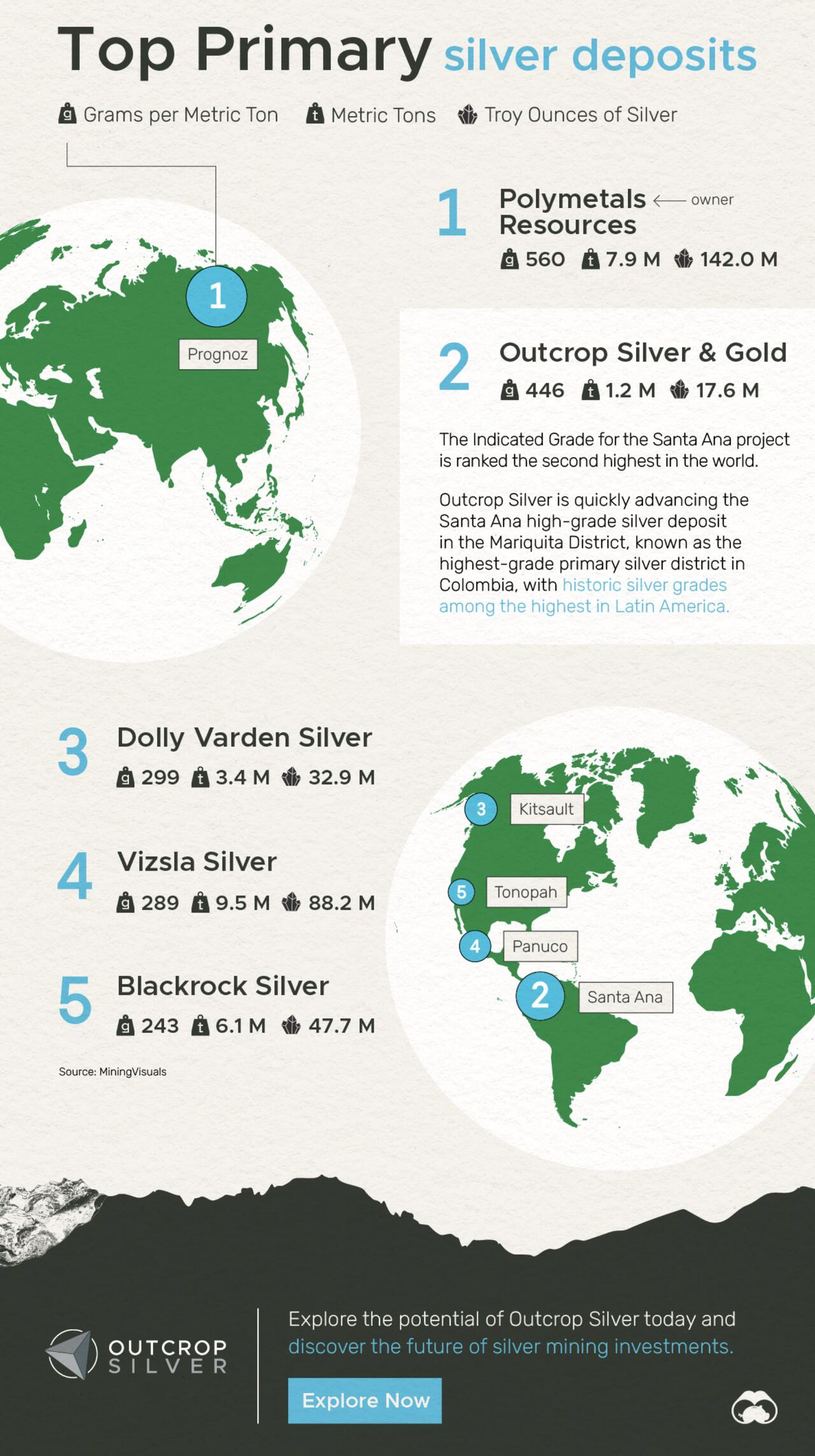

Outcrop Silver is quickly advancing the Santa Ana high-grade silver deposit in the Mariquita District, known as the highest-grade primary silver district in Colombia, with historic silver grades among the highest in Latin America.

The Indicated Grade for the Santa Ana project is ranked the second highest in the world.

Don’t wait for a stock market crash, dedollarization, or CBDCs before securing your retirement with physical precious metals. Genesis Gold Group can help.

What Would You Do If Pharmacies Couldn’t Provide You With Crucial Medications or Antibiotics?

The medication supply chain from China and India is more fragile than ever since Covid. The US is not equipped to handle our pharmaceutical needs. We’ve already seen shortages with antibiotics and other medications in recent months and pharmaceutical challenges are becoming more frequent today.

Our partners at Jase Medical offer a simple solution for Americans to be prepared in case things go south. Their “Jase Case” gives Americans emergency antibiotics they can store away while their “Jase Daily” offers a wide array of prescription drugs to treat the ailments most common to Americans.

They do this through a process that embraces medical freedom. Their secure online form allows board-certified physicians to prescribe the needed drugs. They are then delivered directly to the customer from their pharmacy network. The physicians are available to answer treatment related questions.