Editor’s Note: President Donald Trump is almost certainly going to fix the economy. It would take a bunch of broken promises and some massive unforeseen financial events to prevent him from taking our decimated economy back to the stratosphere. But it’s important that Americans understand this isn’t going to be a quick fix. Many indicators are already showing signs of a return to normalcy but there has been so much damage done the last four years that we are still going to see massive speedbumps and even a couple of roadblocks ahead.

Consumer confidence is up. The stock market, crypto, and gold numbers have looked solid after the initial post-election shock to the system. Things are looking good, but that doesn’t mean we can become complacent. It still behooves Americans to be frugal with spending until all of the dust settles and President Trump’s economic plan can truly kick into action. With that said, here’s some important information from Zero Hedge…

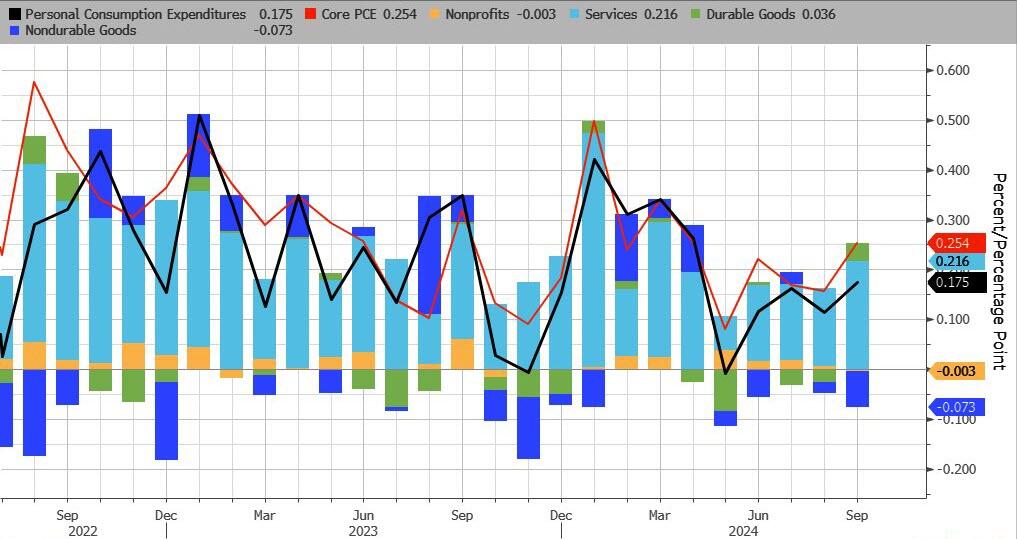

(Zero Hedge)—The Fed’s favorite (when it’s going down) inflation indicator – Core PCE – ticked up noticeably in October to +2.8%, the highest since April…

Headline PCE rose 0.2% MoM (as expected) lifting it 2.3% YoY (up from +2.1% YoY prior)…

A jump in Services and Durable Goods costs drove the reignition of inflation…

The so-called SuperCore PCE (Services ex-shelter) surged up to +3.51% YoY…

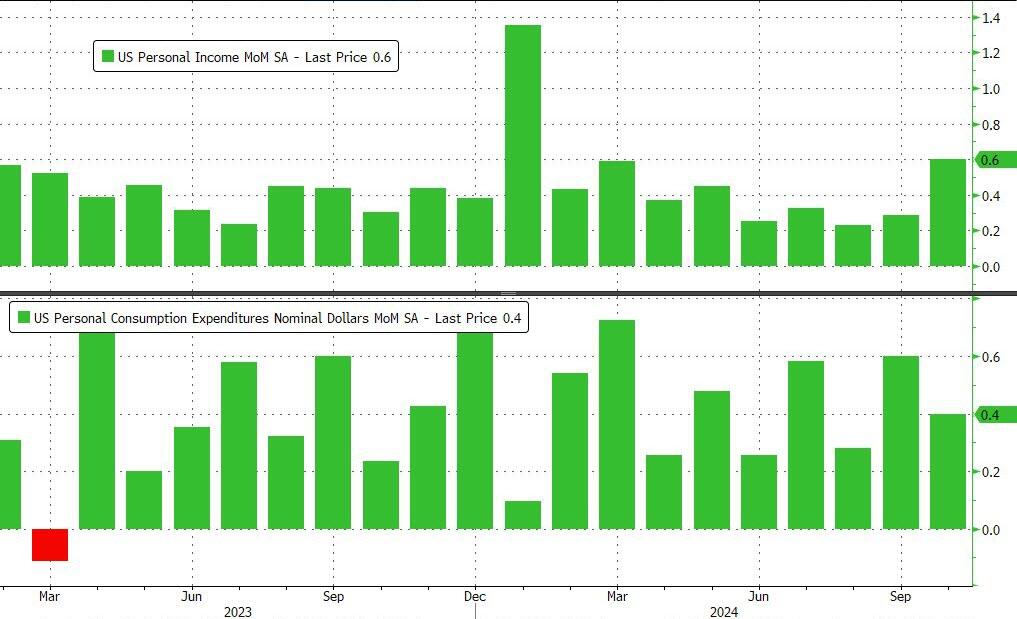

Incomes – for once – grew at a faster rate than spending (+0.6% MoM vs +0.4% MoM respectively)….

…and while that bumped up the savings rate MoM, thanks to massive revisions, Americans lost $140BN in personal savings… out of nowhere…

Oh look, the savings rate was just revised sharply lower for most of 2024 and some $140BN in personal savings was magically erased. pic.twitter.com/T3lGgLCIEQ

— zerohedge (@zerohedge) November 27, 2024

Remember when they revised it from 2.4% to 5.0% in late September to bump up GDP? Well, we guess Kamala isn’t president.. so all bets (adjustments) are off…

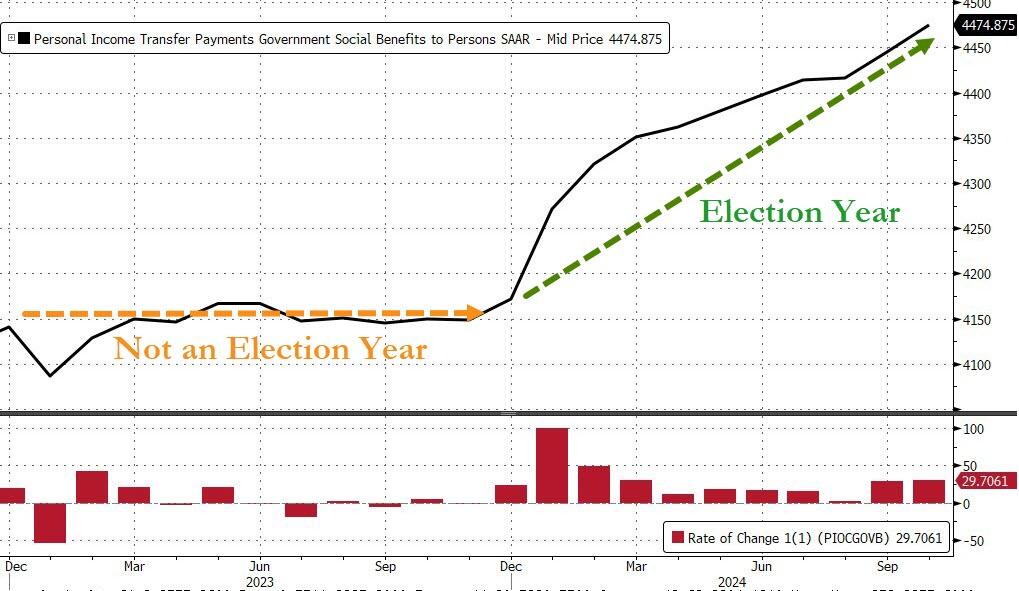

And finally, imagine how bad things would be if the government wasn’t handing over billions to ‘we, the people’ all of a sudden…

Bye, bye, rate-cut expectations!…

It’s becoming increasingly clear that fiat currencies across the globe, including the U.S. Dollar, are under attack. Paper money is losing its value, translating into insane inflation and less value in our life’s savings.

Genesis Gold Group believes physical precious metals are an amazing option for those seeking to move their wealth or retirement to higher ground. Whether Central Bank Digital Currencies replace current fiat currencies or not, precious metals are poised to retain or even increase in value. This is why central banks and mega-asset managers like BlackRock are moving much of their holdings to precious metals.

As a Christian company, Genesis Gold Group has maintained a perfect 5 out of 5 rating with the Better Business Bureau. Their faith-driven values allow them to help Americans protect their life’s savings without the gimmicks used by most precious metals companies. Reach out to them today to see how they can streamline the rollover or transfer of your current and previous retirement accounts.