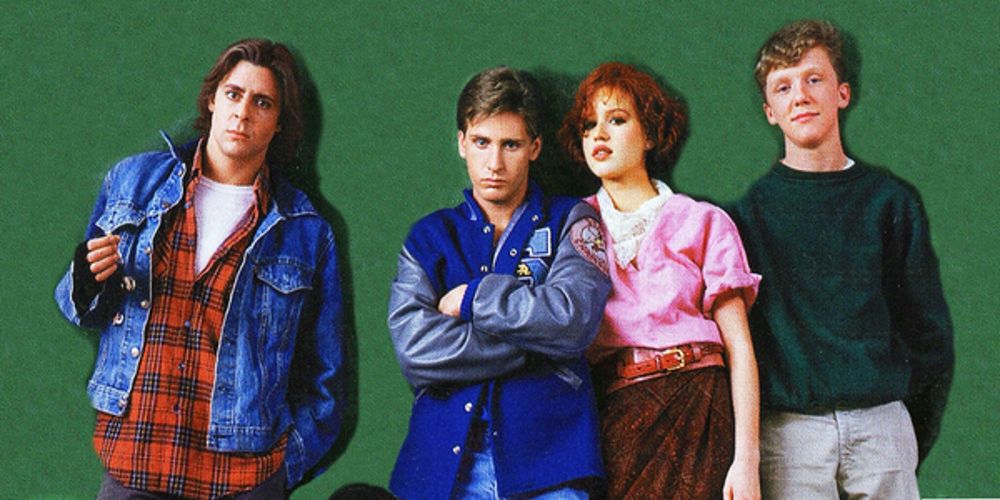

The oldest members of Gen X, the generation born between 1965 and 1980, are coming into their retirement years. This group, known as the “forgotten” generation, had to punch an actual time clock and were the test subjects for 401(k) retirement plans. Now that their golden years are arriving, are they ready for it?

Gen X Retirement

The Gen X clan had some unique challenges in their lives and careers. The Wall Street Journal opined that Gen Xers are financially worse off than their baby boomer predecessors. In 2022, the “median household net worth of Gen Xers between 45 and 54 years old was about $250,000,” which is “about 7% lower than that of baby boomers at the same age in 2007,” as related in the inflation-adjusted Federal Reserve data. “That was the only age group that experienced a drop in median wealth over the 15-year period.”

Media Culture described Generation Xers as having “a pragmatic, self-reliant, and skeptical outlook” on life and work. This cohort experienced social, technological, and economic issues that changed the world and impacted their lifestyles and beliefs. They were the first to witness the influence of the digital revolution, especially as it correlated to work experiences. They also saw the fall of the Berlin Wall, the economic recession of the 1990s, the introduction of the personal computer, the rise of the Internet, the Gulf War, the Los Angeles riots, and the AIDS crisis, all events that affected not only how they lived their lives but also how they looked to the future and their financial stability.

The Gen X crowd was the first to move from company pensions that promised steady income – if they put in years of service – to 401(k) plans that put their financial destiny in their own hands. Many were not prepared. Plus, early variants of 401(k) plans were not automated and did not have the benefits offered today. Saving and planning for retirement was not as easy, and many Gen Xers are finding themselves at the end of their working career without enough funds to see them through their later years. […]

— Read More: www.libertynation.com

It’s becoming increasingly clear that fiat currencies across the globe, including the U.S. Dollar, are under attack. Paper money is losing its value, translating into insane inflation and less value in our life’s savings.

Genesis Gold Group believes physical precious metals are an amazing option for those seeking to move their wealth or retirement to higher ground. Whether Central Bank Digital Currencies replace current fiat currencies or not, precious metals are poised to retain or even increase in value. This is why central banks and mega-asset managers like BlackRock are moving much of their holdings to precious metals.

As a Christian company, Genesis Gold Group has maintained a perfect 5 out of 5 rating with the Better Business Bureau. Their faith-driven values allow them to help Americans protect their life’s savings without the gimmicks used by most precious metals companies. Reach out to them today to see how they can streamline the rollover or transfer of your current and previous retirement accounts.