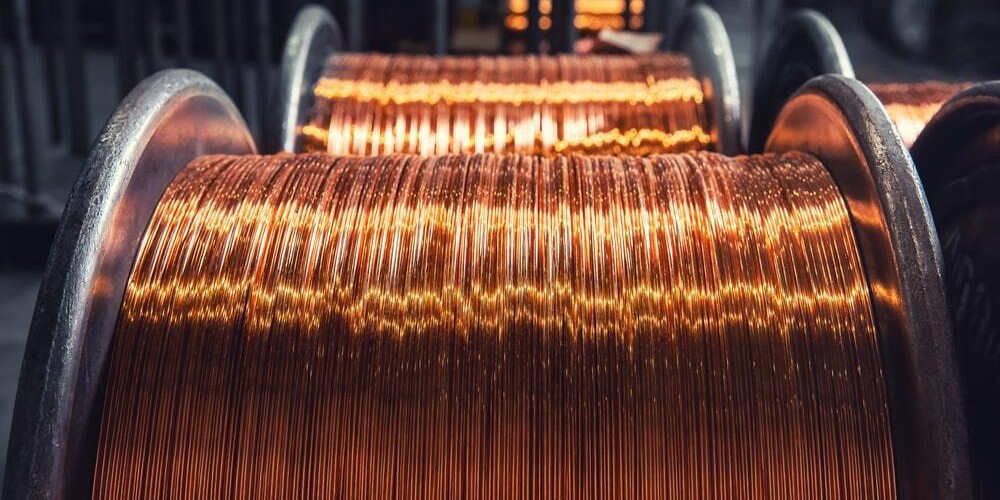

Copper on July 6 plunged below $7,500 a ton, as increasing fears of a global recession hit the industrial metals market, lowering prices from its record highs a months ago.

Article cross-posted from our premium news partners at The Epoch Times.

The price of copper has dropped by 7.1 percent week over week, according to a Twitter post from Hedgeye, an online investment research and financial media company.

Copper fell by as much as 4.9 percent to $7,291.50 a ton on the London Metal Exchange (LMEX)—its lowest level since November 2020 after recovering to $7,552 a ton by 12:43 p.m. BST.

The mineral had already been hit by a 4.2 percent slump yesterday going below $8,000 a ton, reaching its lowest close in 19 months.

Meanwhile, aluminum lost 0.7 percent in value, while nickel was down 2.2 percent, and lead climbed 1.9 percent.

This is major turn from March, when the LMEX Index of six strategic metals rose to an all-time high after the Russian invasion of Ukraine sparked fears of global fuel and commodities shortages.

This last quarter witnessed the worse results for metals since the 2008 Great Recession, with the current month bringing little relief, as the risk of a recession dominates market sentiment.

Investors are worried over shake ups in the supply chain, such as the Russian sanctions-induced fuel crisis in Europe, a faltering American economy, and severe central government-induced lockdowns in Mainland China.

Companies hoped that China would be a major source for demand for commodities, after the CCP had promised to restart growth in the second half of 2022.

Don’t just survive — THRIVE! Prepper All-Naturals has freeze-dried steaks for long-term storage. Don’t wait for food shortages to get worse. Stock up today. Use promo code “jdr” at checkout for 25% off!

Meanwhile in America, there are also increasing concerns over the Federal Reserve’s aggressive and delayed interest rate policy, which may instigate a severe and sustained downturn, while trying to tame rising inflation.

The central bank’s attempt to curb demand is already beginning to curb U.S. economic growth.

The meeting minutes from the Federal Reserve’s last FOMC conference on June 14 came out this morning, suggesting another 50 or 75 basis point move in July.

“In discussing potential policy actions at upcoming meetings, participants continued to anticipate that ongoing increases in the target range for the federal funds rate would be appropriate to achieve the Committee’s objectives,” the minutes stated.

- Concerned about your life’s savings as the multiple challenges decimate retirement accounts? You’re not alone. Find out how Genesis Precious Metals can help you secure your wealth with a proper self-directed IRA backed by physical precious metals.

“In particular, participants judged that an increase of 50 or 75 basis points would likely be appropriate at the next meeting.”

“Participants recognized that policy firming could slow the pace of economic growth for a time, but they saw the return of inflation to 2 percent as critical to achieving maximum employment on a sustained basis,” the board members admitted.

Analysts are now shifting their focus from inflation to whether and when a U.S. recession will hit, with the chances of an economic contraction now standing at 38 percent, according to Bloomberg Economics.

Falling commodity prices are a key sign that there will likely be a recession in the United States this year, according to Joe Terranova, chief market strategist at Virtus Investment Partners to CNBC on July 5.

He believes that a recession is likely to happen this year, rather than in early 2023, as others have suggested.

“It’s obvious to us that the recession conversation shouldn’t be about one in 2023,” Terranova said. “It should be about one in 2022—if we’re not already in one right now.”

Investors should keep an eye on oil, copper, lumber, agriculture, and soft commodity prices, he said, noting that they are a potential harbinger of recession, as a major drop would signal deflationary pricing.

Before every recession in the past three decades, falling copper prices have been a sign of a pending economic crisis.

“The calendar has turned into July, and the market isn’t pricing based on inflation, it’s pricing based on an expected recession,” Terranova said.

Oil prices fell in June, after topping $120 a barrel in March and April, with Brent crude dropping 13 percent at $104 a barrel today, while West Texas International crude fell 16 percent to hover just over $100 a barrel.

Lumber futures have been down at least 27 percent over the last three months, as rising housing costs and mortgage rates curb demand for building materials.

If rising inflation continues and an economic downturn hits, demand will take a severe fall.

Analysts anticipate investors rushing to the U.S. dollar as a safe haven during the period of market instability, adding further pressure.

It’s becoming increasingly clear that fiat currencies across the globe, including the U.S. Dollar, are under attack. Paper money is losing its value, translating into insane inflation and less value in our life’s savings.

Genesis Gold Group believes physical precious metals are an amazing option for those seeking to move their wealth or retirement to higher ground. Whether Central Bank Digital Currencies replace current fiat currencies or not, precious metals are poised to retain or even increase in value. This is why central banks and mega-asset managers like BlackRock are moving much of their holdings to precious metals.

As a Christian company, Genesis Gold Group has maintained a perfect 5 out of 5 rating with the Better Business Bureau. Their faith-driven values allow them to help Americans protect their life’s savings without the gimmicks used by most precious metals companies. Reach out to them today to see how they can streamline the rollover or transfer of your current and previous retirement accounts.