Fed Chairman Jerome Powell held a press conference at the annual Jackson Hole economic conference today, and he all but said that a September cut to the federal funds rate is a done deal: “The time has come for policy to adjust. The direction of travel is clear.”

Naturally he threw in the usual propaganda phrases about how the Fed is data driven. He continues: “the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

Remember, with its official statements, the Fed is always careful to try and give the impression that it is not a political organization and responds only to economic data.

But, for whatever reason, Powell and the Fed have now decided official CPI inflation is low enough for the central bank get away with NEW infusions of easy money, even as stocks, rents, home prices, and food prices are all at record high.

On price inflation, Powell all but declares “mission accomplished”: “With an appropriate dialing back of policy restraint, there is good reason to think that the economy will get back to two percent inflation while maintaining a strong labor market.”

So, in addition declaring victory over rising prices – even though last month’s official CPI growth was still nearly 3 percent— Powell is again pushing the myth of the “soft landing” even though there is absolutely no reason to believe the Fed can engineer such a thing.

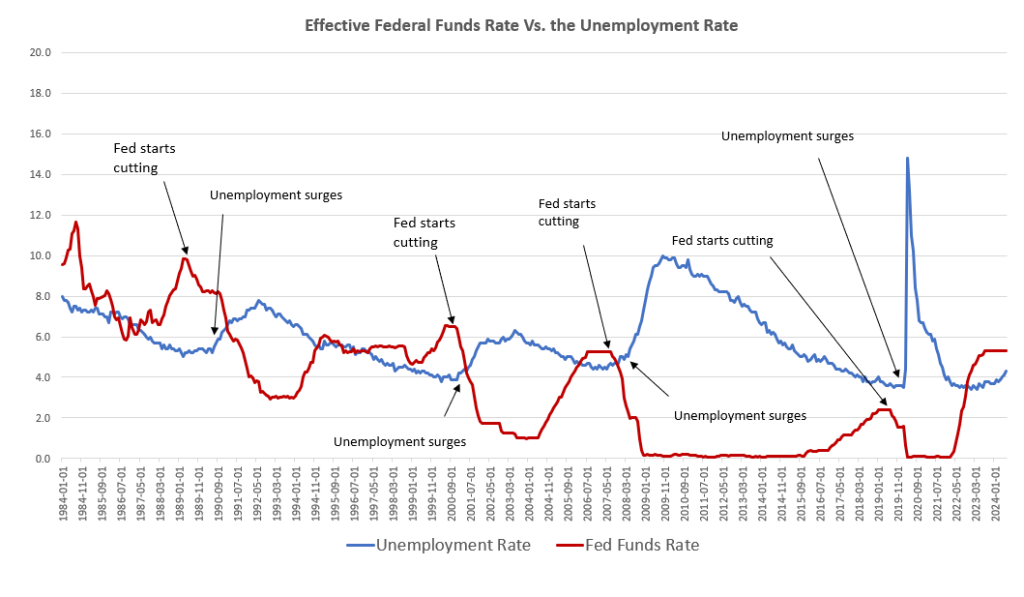

In fact, if anything, the fact that the Fed now plans to start cutting rates is one of the strongest recession signals we can get.

If we look back at the relationship between rate cuts and recessions, we see that in almost every case that recessions begin shortly after the Fed starts a cycle of rate cuts. The fed started cutting the Fed funds rate in 1989. Then we got the recession of the early 90s. In late 2000, the fed started the rate cuts again. We got a recession in 2001. The Fed did it again in late 2007. The recession began in December 2007, followed by a financial crisis several months later. This relationship even holds for the 2020 recession because even without covid there would have been a recession in late 2020. The Fed had begun to ease the target rate in summer 2019.

Fed rate cuts don’t cause recessions, of course. The boom-bust cycle is caused by reckless Fed-driven money creation.

But it makes sense that the Fed hits the panic button and starts cutting rates when it does because the Fed is reacting to fears about impending recessions. The same is true this time around. The Fed has no special prediction skills, so it sees what the rest of us see: a weakening economy and a much less rosy employment picture than what was sold to us by the administration over the past year. July’s weak jobs report with rising unemployment, combined with this week’s massive downward revision in 2023-2024 jobs numbers, gives us good reason to figure that the Fed is now trying to prevent a recession by flooding the economy with more easy money. […]

Survival Beef on sale now. Freeze dried Ribeye, NY Strip, and Premium beef cubes. Promo code “jdr” at checkout for 25% off! Prepper All-Naturals

— Read More: mises.org

It’s becoming increasingly clear that fiat currencies across the globe, including the U.S. Dollar, are under attack. Paper money is losing its value, translating into insane inflation and less value in our life’s savings.

Genesis Gold Group believes physical precious metals are an amazing option for those seeking to move their wealth or retirement to higher ground. Whether Central Bank Digital Currencies replace current fiat currencies or not, precious metals are poised to retain or even increase in value. This is why central banks and mega-asset managers like BlackRock are moving much of their holdings to precious metals.

As a Christian company, Genesis Gold Group has maintained a perfect 5 out of 5 rating with the Better Business Bureau. Their faith-driven values allow them to help Americans protect their life’s savings without the gimmicks used by most precious metals companies. Reach out to them today to see how they can streamline the rollover or transfer of your current and previous retirement accounts.

Interesting phenomena. You’d think more money in circulation would result in more job-producing activity. I’m no economist, but I guess it might make some sense to me considering most of the money being loaned is private money, even when the government is printing money. So interest rates set by the Fed ripple through. Investors then earn less return, which may slow investment, change strategies, etc. That, and whatever the money is being borrowed for is not going to any sort of job-producing activity. I imagine it is difficult to quantify how much is actually in circulation in a manner that amounts to economic activity, and how much is held back. And I’m sure there are other factors I don’t know and haven’t thought of.

The theoretical egg heads aren’t likely to do anything unless they fully understand the “why”. But if you have an isolated and measurable cause and effect, you don’t have to understand why. Right, science doesn’t know exactly what gravity is. But it’s behavior is consistent enough, measurable enough, observable enough, that it is used and taken into account all day every day.

That’s the difference between a theoretical scientist and a practical engineer.

We have too many egg-headed theorists, with their heads in the clouds. And not enough “engineers” dealing with the practical reality.

Interesting to think about, though.

* its