Like many retirees, Jesus Nunez knew he was due a pension but was having a hard time tracking it down. Now 66, the Burbank, Illinois, resident had worked as a painter and garage worker for the Checker Taxi Co. Inc from 1978 to 1986 and then another year for its successor concern. But when Checker Motors filed for Chapter 11 bankruptcy in 2009, he never got a notice about his anticipated retirement checks. He figures he’s due about $300 per month.

“They didn’t tell me anything about my pension,” says Nunez. “Later someone said they lost my records.”

Don’t just survive — THRIVE! Prepper All-Naturals has freeze-dried steaks for long-term storage. Don’t wait for food shortages to get worse. Stock up today. Use promo code “jdr” at checkout for 35% off!

Nunez’s concerns are shared by millions of Baby Boomers who are in or nearing retirement. Although so-called defined-benefit pensions were long considered the gold standard of retirement plans – promising guaranteed regular payments for life – corporate churn, financial pressures and outright fiscal malfeasance have made many of them less secure than the employee-guided, non-guaranteed 401k stock investment plans that many companies now offer in their stead.

Only about 10% of private-sector workers have defined-benefit pensions today. But prior to the 1980s, most did. That fact, and what happened to guaranteed pensions in the interim, make them a persistent problem today, ensnaring, among others, American taxpayers who have to bail out a lot of them.

Many affected workers and retirees – potentially 33 million in more than 25,000 federally protected defined-benefit pension plans – are among the more than 70 million Baby Boomers (those born from 1946 to 1964) who are retiring at an accelerating rate, with only some 40% already retired.

That means the first federal backstop for such pensions created by Congress in 1974 – the Pension Benefit Guaranty Corporation – is being kept busy dealing with troubled plans, about 1,600 terminations annually in recent years. From 2014 to 2019, there were 8,000 shutdowns. All told, more than 145,000 plans shuttered from 1975 to 2019, with the PBGC becoming trustee for almost 5,000 of them.

Multi-employer pensions, generally offered to union members, typically saw the biggest funding shortfalls with some funded at only 30% to 40% of their obligations, according to a University of Virginia study. These pensions were thrown a stopgap, multi-billion-dollar lifeline by President Biden’s $1.9 trillion American Rescue Plan Act passed last year by the Democrat-run Congress.

“Pension managers—including politicians, union officials, and employer representatives—consistently over-promised and under-funded pension benefits, and have done little if anything to correct for their shortcomings over time,” writes Rachel Greszler, a research fellow at the Heritage Foundation. “Such mismanagement is tragic for workers and retirees who did nothing wrong.”

The situation raises the specter of a fiscal crisis on the order of much more publicized problems involving government support for Americans’ personal finances, from potential Social Security insolvency to mismanaged public employee pensions – as opposed to the private ones at issue here. The moral hazards posed by government guarantees extend to student loans, with President Biden proposing a bailout of hundreds of billions of dollars in student debt. Ironically, the unlucky older beneficiaries who lost private pensions could see their taxes go to bail out those younger borrowers.

And the private pension problem still festers: The Great Resignation of older workers in the pandemic era threw Social Security earnings and retirement savings off track, making the issue of failing pensions even more pressing to those with a claim to them.

What is the government doing about it, and what can impacted retirees do to protect themselves?

Below is a primer.

How You Can Track Down a Lost Pension

Have a guaranteed pension dating back to the days of disco? Hunting it down and getting the checks due you can be an unusually arduous process. Although you may have received official notices of pension benefits, companies offering them may have folded or changed names over the years, with their pension plans taken over by others. Remember Times Mirror, the newspaper giant of decades ago now gone down the memory hole? Pension search engines aren’t likely to either.

Tips:

- Documents are king in this process – i.e. paperwork saying you were vested and owed a pension. You may first need to track down your former employer.

- The PBGC provides a list of “trusteed” plans that it has taken over. If your plan is being managed by the agency, then that’s your first stop, although you may have no way of knowing that. You can call the agency at 1-800-400-7242.

- The PBGC’s pension search directory is another resource.

- You can also try the PBGC’s “My Pension Benefits” portal.

- The PBGC has an “Advocate” office that offers “pension tracing services.” Call (202) 229-4448 or advocate@pbgc.gov.

- If your own work records are long gone and the above steps prove fruitless, your last resort for proving your claim to a pension might be a Certified Itemized Statement of Earnings from Social Security, listing when you worked and for whom. That will cost $122 and likely take 120 days to process, Social Security says. It gives a number to call, 1-800-772-1213, but only after that four-month wait period.

When a company files for bankruptcy, a plan may be also terminated by a court or continued without PBGC intervention – if there are enough assets in the plan.

It’s helpful to know what kind of termination an employer chooses when electing to shut down a defined-benefit plan.

- Standard Terminations. The majority of plans are shuttered under this category, which means “a plan that has enough money to pay all benefits owed to participants and beneficiaries…For each participant or beneficiary, the plan administrator either purchases an annuity from an insurance company or, if the plan permits, pays the benefit owed in another form (such as a lump sum),” according to the PBGC.

- Distress Terminations. This is when the employer or “controlled” group can’t fund future benefits and meets certain PBGC rules. Then the “PBGC takes over the plan as trustee and uses its own assets and any remaining assets in the plan to make sure that current and future retirees of the plan receive their pension benefits, within the legal limits. PBGC also tries to collect plan underfunding from employers and shares a portion of its recoveries with participants and beneficiaries.” This is a more involved process, though, and the full benefits promised under the original plan may not be paid.

When the PBGC takes over a single-employer plan, it typically pays participants their plan benefits in the form of a life annuity. The benefits, however, are capped based on the PBGC’s “guarantee limit,” so many retirees may not receive what they were originally promised by the plan.

The guaranteed level for 2022 for an annuity for the life of a participant whose benefit commences at age 65 is $74,455. You have to be vested in the plan, meaning you had to have worked for the company a certain number of years to qualify for a benefit. The guaranteed amounts vary by age. Generally, the older you are, the higher the benefit. The potential payment is lower if a benefit commences before age 65 or if the participant’s spouse has a survivor benefit. The guarantee is higher if the benefit commences after age 65.

“People whose pension benefits exceed the guarantee amount thus can lose some of their promised benefits, but in some situations people who are already retired when the plan terminates may be paid benefits in excess of the guarantee levels,” says Norman Stein, a national pension expert and senior policy and legal counsel for the Pension Rights Center.

“In multiemployer plans—collectively bargained plans to which several employers contribute—the guarantees are much lower than they are for single employer plans.”

Keep in mind that it’s difficult to decipher what underfunding means. It’s a fluid process. Employers may pony up more contributions, or market returns may improve a plan’s fiscal health. Gauges showing how long a pension plan will be able to pay full benefits are complex and understood by few.

Still, tracking down owed benefits can be a wild goose chase with a lot of dead ends. You may need professional help, someone who can aid you in finding the right documents and asking the right questions. PensionHelp America is a good place to start.

What the Government Is Doing to Help

Although most workers are required to receive official notices when their pensions are underfunded, terminated, and taken over by the PBGC, they may be long gone from the workplace. The Labor Department, separate from the PBGC, maintains a list of the most underfunded multi-employer plans, but it provides little direct help for workers looking for unclaimed pensions.

But finding plans that have shut down may be easier than finding some that still have money in them and owe benefits. There are more than 16 million retirement accounts sitting out there (including 401ks) – typically with balances of $5,000 or less, according to the Government Accountability Office. It’s not a simple matter to do a search engine query to find them. Congress has authorized the PBGC and other agencies to set up a user-friendly “lost and found”database or “registry” of pensions, but it may not be up and running for a few years.

“We have developed a technology roadmap for a pension plan registry system,” notes a spokesperson for the PBGC Advocate Office, “and we are now in the process of evaluating options for building and implementing the pension plan registry system architecture. In the interim, the Office of the Advocate continues to offer pension tracing services to participants seeking information about a defined benefit plan.

What about bolstering underfunded plans? The Democrat-dominated Congress under President Biden has been kind to the multi-employer plans generally offered to union members, to the tune of billions of dollars from the $1.9 trillion American Rescue Plan Act of 2021. Under the ARPA, a Special Funding Assistance Program was embedded in what became known as the “Butch Lewis Act,” named by liberal Ohio Sen. Sherrod Brown for late Cincinnati ex-Teamsters president and pension advocate Estil “Butch” Lewis. It supports about 250 most “severely” underfunded plans, the PBGC stated in its fiscal 2021 Annual Report.

While the program will aid the most troubled multi-employer pension programs, it won’t eliminate the total underfunding issue long-term. The PBGC’s most recent Office of Inspector General audit estimates that it could be on the hook for about $329 million for multi-employer plans alone – after its nearly $9 billion infusion thanks to the Lewis Act. Funding shortfalls, in essence, were covered by the Lewis Act, which allowed loans to plans in “critical and declining status,” or if a plan became insolvent after December 2014 and had not terminated.

Before the pandemic and the ARPA, some 1.3 million workers were in troubled multi-employer plans. But now, observes Karen Friedman, executive director of the nonprofit Pension Rights Center: “If your plan is accepted and qualified for the special assistance, most people won’t have to worry (this is for multi-employer plans only).”

In any case, sorting through the PBGC’s enormous growing liabilities, it’s likely that Congress may need to pony up billions more to guarantee future defined-benefit pensions.

“The doomsday scenario that the PBGC would become insolvent in five to six years is now old history,” according to Grace Ristuccia and Thomas Vasiljevich, writing recently in The National Law Review. “The new estimated time of PBGC insolvency is the mid-2040s.”

The potential bill for underfunded single-employer plans, however, was much larger at $105.4 billion, the PBGC audit reported for the last fiscal year (page 24). This number focuses on companies that have below investment-grade credit ratings with plans classified as “reasonably possible of termination” as of the end of September last year. Actually, that liability figure is an improvement from $176 billion in fiscal year 2020. Nevertheless, the PBGC is not out of the woods when it comes to future liabilities.

Neither are the many retirees in the same boat as Jesus Nunez, the former Checker Motors worker, who is now working to recover his pension with the help of Anna-Marie Tabor of the Pension Action Center at the University of Massachusetts-Boston.

“There’s often a complete lack of transparency,” Tabor said of what’s become painfully obvious to those adversely affected. “Some people have no idea what happened to their pension plans.”

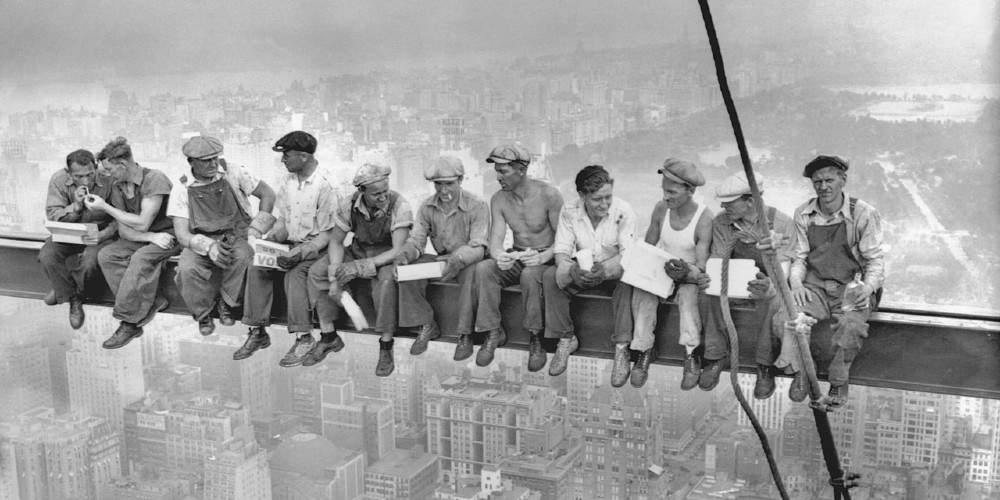

Image by Charles Clyde Ebbets, Public domain, via Wikimedia Commons. Article cross-posted from Real Clear Investigations.

The bottom line to all of this is that those of us who did not ever have any sort of a guaranteed pension or retirement, worked for far lower salaries, and did our best to save what little we could, will end up having to pay higher taxes to the Federal Government so they can bail out all these criminally conceived ponzi-scheme plans to pay out to people who will be drawing more annually in retirement than we will ever make during our entire time as tax paying, full-time employees. As if this private sector version of “social security” isn’t bad enough, there’s social security that we’re paying more into now than we’ll ever see in benefits since the money we pay in goes straight out the door to pay the benefits of those folks already retired, whose money was already spent by the criminal politicians that was supposed to be in Al Gore’s lock box to be paid to them today. ALL the politicians that voted to create and continue this massive vote-buying ponzi-scheme should be put in cells in the same facility which served as the “retirement home” for Bernie Madoff.

I’ve been wait’n for this sh*** … this is gonna be sweet … more poverty …. what happens when you’re old – hungry – broke and hopeless – go watch the movie Falling Down …

Now you give a shit why .. cause that’s all you got left you own. Just a pile of sh*&# … Man is the destruction of America gonna be fun to watch ….