(Zero Hedge)—The so-called “debasement trade” into gold and Bitcoin is “here to stay” as investors brace for persistent geopolitical uncertainty, according to a Jan. 3 research note by JPMorgan shared with CoinTelegraph.

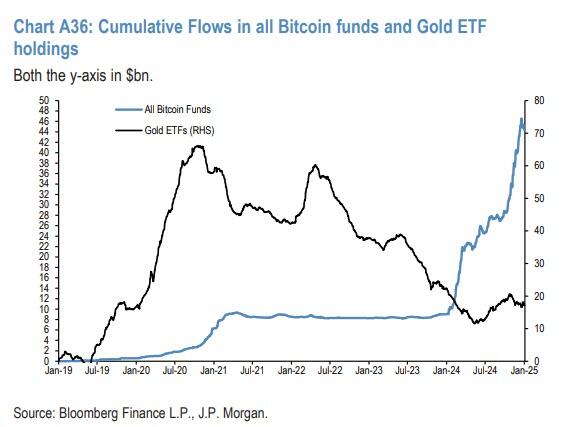

Gold and BTC “appear to have become more important components of investors’ portfolios structurally” as they increasingly seek to hedge against geopolitical risk and inflation, the bank said, citing the “record capital inflow into crypto markets in 2024.”

The debasement trade refers to increasing demand for gold and BTC due to factors ranging from “structurally higher geopolitical uncertainty since 2022, to persistent high uncertainty about the longer-term inflation backdrop, to concerns about ‘debt debasement’ due to persistently high government deficits across major economies,” among others, JPMorgan said.

Institutional inflows

Investment managers including Paul Tudor Jones are longing Bitcoin and other commodities on fears that “all roads lead to inflation” in the United States.

US state governments are also adding Bitcoin as “a hedge against fiscal uncertainty,” asset manager VanEck said in December.

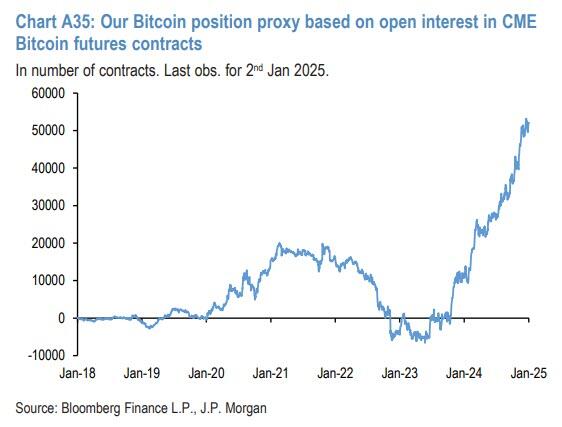

In October, JPMorgan cited spiking open interest on BTC futures as another indicator that “funds might see gold and Bitcoin as similar assets.”

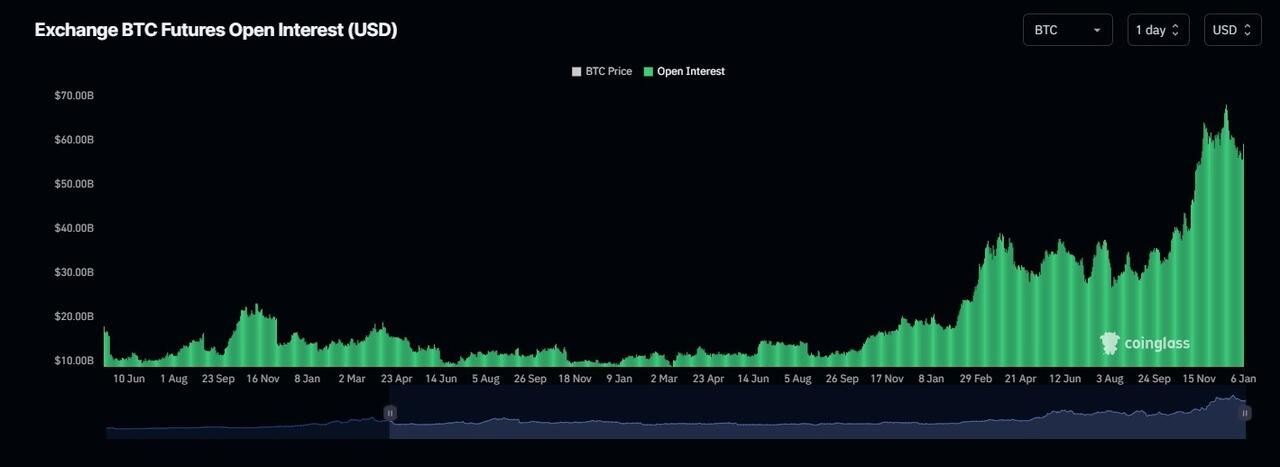

In 2024, net open interest on BTC futures rose from approximately $18 billion in January to upward of $55 billion in December, according to data from CoinGlass.

“In addition, the fact that Bitcoin [exchange-traded funds] started seeing inflows again in September after an outflow in August suggests that retail investors might also see gold and Bitcoin in a similar fashion,” JPMorgan said in October.

In November, US Bitcoin ETFs broke $100 billion in net assets for the first time, according to data from Bloomberg Intelligence.

Crypto ETF inflows are among the most important metrics to watch because they are “more likely than other trading activity to be new funds/market participants entering the crypto space,” according to a December report by Citi shared with Cointelegraph.

Survival Beef on sale now. Freeze dried Ribeye, NY Strip, and Premium beef cubes. Promo code “jdr” at checkout for 25% off! Prepper All-Naturals

Surging institutional inflows could cause positive “demand shocks” for Bitcoin, potentially sending BTC’s price soaring in 2025, asset manager Sygnum Bank said in December.

* * *

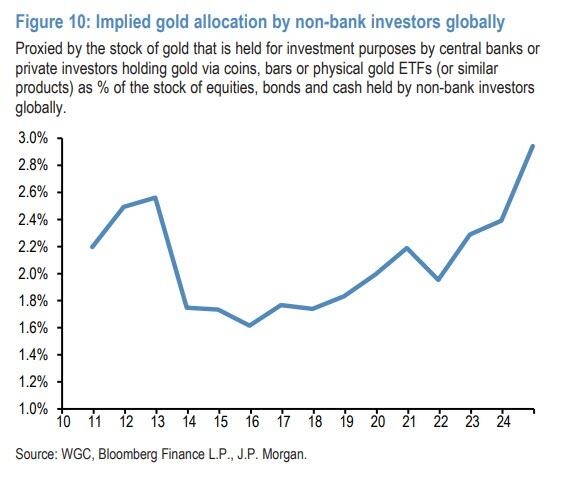

[ZH: The structural rise of gold in investors’ portfolios is best shown in the chart below, which proxies gold allocation globally via the stock of gold that is held for investment purposes by central banks or private investors holding gold via coins, bars or physical gold ETFs (or similar products) as % of the stock of equities, bonds and cash held by non-bank investors globally.

It’s becoming increasingly clear that fiat currencies across the globe, including the U.S. Dollar, are under attack. Paper money is losing its value, translating into insane inflation and less value in our life’s savings.

Genesis Gold Group believes physical precious metals are an amazing option for those seeking to move their wealth or retirement to higher ground. Whether Central Bank Digital Currencies replace current fiat currencies or not, precious metals are poised to retain or even increase in value. This is why central banks and mega-asset managers like BlackRock are moving much of their holdings to precious metals.

As a Christian company, Genesis Gold Group has maintained a perfect 5 out of 5 rating with the Better Business Bureau. Their faith-driven values allow them to help Americans protect their life’s savings without the gimmicks used by most precious metals companies. Reach out to them today to see how they can streamline the rollover or transfer of your current and previous retirement accounts.