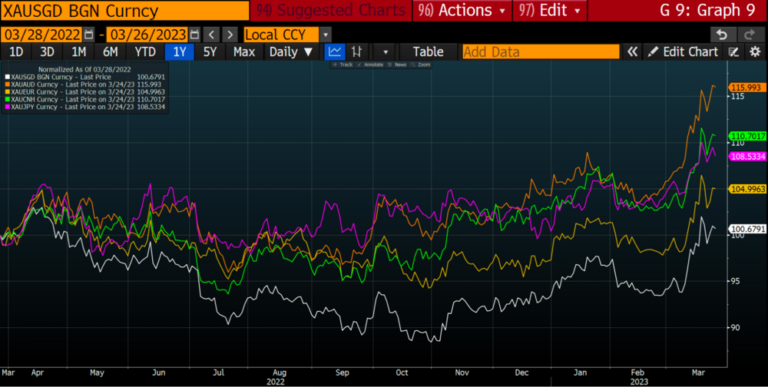

Something is happening with gold, and it isn’t just against the dollar as it is all strong and muscly in multi-currency terms. Yes, you could make the case for the “banking crisis” being the reason why gold has popped up over the last month. However, gold has been etching higher over the last six months in dollar terms and longer in other currencies.

Gold in SGD, AUD, EUR, CNH, JPY indexed to 100 – year-to-date

And it seems to have been working off an overbought condition over the last couple of years. If this was a flash in the pan thing for gold, it should have given back all its gains of 2020 on the back of Covid (as the Nasdaq has). Also note gold was already moving higher in 2019 way before Covid.

So it would seem to us that the COVID scam and the recent banking crisis/circus is just “fleas on a dog’s back” for gold — there is something “systemic” going on. The lack of trust on a global scale is revealing itself in gold.

We have a strong conviction that this is the tip of the iceberg (i.e. the upside of gold in multi-currency terms is a long way from being done).

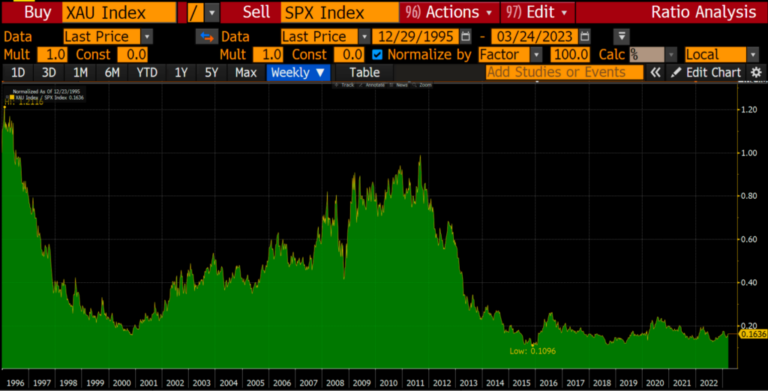

Long term it would seem that the odds are in favor of gold outperforming the world stock market.

I know there is a lot to take in, and I’m going to show you yet another chart, but this is truly revealing.

Gold in SGD, AUD, EUR, CNH, JPY indexed to 100 – last 20 years

This takes us back to 2000 — 20-odd years ago. Multi currencies against the yellow metal indexed to zero. Is this not monetary debasement in a simple picture?

Obviously, it depends on where you take your time period from, but from 1990 the world stock market is up some 380% whereas gold is up 450%. So it could be argued that all the gains in the world stock market have been on the back of monetary debasement.

Survival Beef on sale now. Freeze dried Ribeye, NY Strip, and Premium beef cubes. Promo code “jdr” at checkout for 25% off! Prepper All-Naturals

There is one key thing we left out in the chart above — the effect of compounding dividends. If we include dividends and assume they are reinvested, then the return of the world stock market goes to 710%, but around half of those returns are accounted for by monetary debasement.

Our thinking is that, longer-term (a 10-year view), holding a “whack” of your money in gold (physical or an ETF) in preference to the general equity market (or other growth orientated ETFs) isn’t a stupid idea and is actually a no brainer.

Are we on the verge of massive outperformance of gold relative to the S&P? Like the 1970s or even from 2000 to 2013? Well, stranger things have happened. Note that when gold gets going, the trends tend not to last for just a couple of years but rather 10 years at least.

Here is where things are far from being a no-brainer… What is going to outperform over the next 10 years or so? Gold or gold miners?

Don’t wait for a stock market crash, dedollarization, or CBDCs before securing your retirement with physical precious metals. Genesis Gold Group can help.

From 1983 to 2008, gold and gold miners tracked each other reasonably well. Then, from mid-2008 (the onset of the GFC), something happened and gold has outperformed miners dramatically. Sorry, but 1983 is as far back as the XAU (Philadelphia Gold Miners Index) goes.

Gold miners (XAU) and gold spot indexed to 1 as of 1983

Zooming into the period from mid-2008 until present, we can see in the chart below that gold miners have underperformed gold by some 70%, although they have moved in lockstep since the start of 2015 (eight years).

What is the reason for this underperformance?

Some say it is because of the increase in costs from energy. Yet, from 2008 until present, crude (a good proxy for diesel prices) has gone down relative to gold.

The contrarian in us suggests that we are approaching a time for gold miners to outperform gold. But we are lacking a fundamental reason for that genius idea.

Stacking up relative to the S&P 500 we can see in the chart below that the gold miners have performed more or less in line with the S&P 500 since the start of 2015.

And gold miners are as out of favor as they were during the height of the TMT/dot-com bubble of 2000.

In a nutshell:

- We don’t think it is going to be difficult to outperform the S&P 500 with a basket of gold miners over the next 10 years

- Whether or not you would be better off investing in gold miners or gold, toss a coin… or go 50/50 GDX and GLD — Newmont and Krugerrand or whatever tickles your fancy.

What else?

Is gold foretelling us of an impending monetary crisis?

Well, we do know one’s coming so…

Editor’s Note: The Western system is undergoing substantial changes, and the signs of moral decay, corruption, and increasing debt are impossible to ignore. With the Great Reset in motion, the United Nations, World Economic Forum, IMF, WHO, World Bank, and Davos man are all promoting a unified agenda that will affect us all.

To get ahead of the chaos, download our free PDF report “Clash of the Systems: Thoughts on Investing at a Unique Point in Time” by clicking here. Article cross-posted from International Man.

It’s becoming increasingly clear that fiat currencies across the globe, including the U.S. Dollar, are under attack. Paper money is losing its value, translating into insane inflation and less value in our life’s savings.

Genesis Gold Group believes physical precious metals are an amazing option for those seeking to move their wealth or retirement to higher ground. Whether Central Bank Digital Currencies replace current fiat currencies or not, precious metals are poised to retain or even increase in value. This is why central banks and mega-asset managers like BlackRock are moving much of their holdings to precious metals.

As a Christian company, Genesis Gold Group has maintained a perfect 5 out of 5 rating with the Better Business Bureau. Their faith-driven values allow them to help Americans protect their life’s savings without the gimmicks used by most precious metals companies. Reach out to them today to see how they can streamline the rollover or transfer of your current and previous retirement accounts.