![]() (Daily Caller)—Prices across the economy have skyrocketed since President Joe Biden first took office, hurting Americans in certain sectors more than others due to inflation and regulations, according to experts who spoke to the Daily Caller News Foundation.

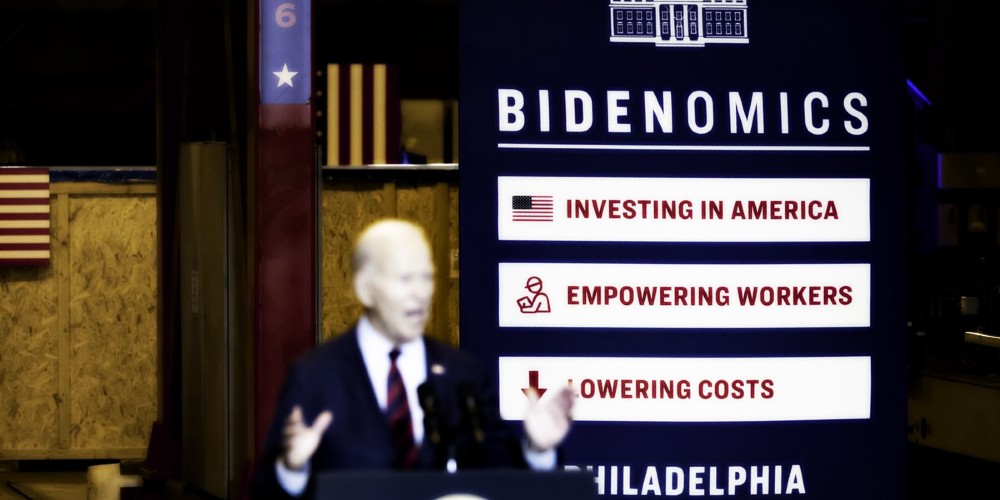

(Daily Caller)—Prices across the economy have skyrocketed since President Joe Biden first took office, hurting Americans in certain sectors more than others due to inflation and regulations, according to experts who spoke to the Daily Caller News Foundation.

Since January 2021, when Biden first took office, the consumer price index (CPI), a measure of inflation, has risen 17.1%, ending in October, according to the Federal Reserve Bank of St. Louis (FRED). Cost increases due to inflation and regulations are hitting every area of the economy, with housing, health care, appliances and car loans experiencing particularly significant impacts, according to experts who spoke with the DCNF.

“I would say that the effect on mortgage rates has been the thing most affected,” Michael Faulkender, chief economist and senior advisor for the Center for American Prosperity, told the DCNF. “Because of 40-year-high inflation from excessive government spending, the Federal Reserve has aggressively raised interest rates. When Joe Biden took office, the average 30-year mortgage rate was 2.77%. Today, it is 7.22%.”

Overall inflation reached a recent peak of 9.1% in June 2022 and has since decelerated to 3.2% in October year-over-year, still far above the Federal Reserve’s 2% target. In response to the high inflation, the Fed raised its federal funds rate to a range of 5.25% and 5.50%, the highest rate in 22 years, placing upward pressure on credit conditions.

The costs to pay for housing expressed in the CPI for shelter, which more closely follows the cost of rent, have risen 17.5% since Biden took office, slightly higher than general price increases, according to FRED.

Many economists point to high government spending under the Biden administration as one of the key causes of elevated inflation. Biden signed the American Rescue Plan in March 2021 and approved the Inflation Reduction Act in August 2022, which added $1.9 trillion and $750 billion in new spending, respectively.

Coffee the Christian way: Promised Grounds

“To put that number in perspective, at 2.77%, a $250k mortgage would have a monthly principal and interest payment of approximately $1,023 per month,” Faulkender told the DCNF. “At 7.22%, that same $250k loan has a payment of $1700 per month. That is why pending home sales have hit their lowest level in two decades. If one looks at rental costs, they have been one of the largest contributors to the ongoing inflation people are facing and it is usually the largest component of a household’s budget.”

In August 2023, a family with a median income could only afford a 30-year mortgage on a $356,272 home following interest rate and price increases, while that same family could afford a mortgage on a $737,392 house in December 2020.

“When some goods are hurt worse than others, the causes are not inflation,” Ryan Young, senior economist at the Competitive Enterprise Institute, told the DCNF. “Higher-than-inflation housing and health care costs are due to regulations and supply chain problems — or at least the higher-than-inflation parts are.”

Health care costs are being ratcheted up due to rising premiums, which increased 7% just this year as of October, increasing 22% over the last five years. In an effort to bring down prices, the Biden administration announced in August that it would be forcing negotiations on ten major drugs.

The Biden administration has outpaced the previous three administrations in terms of issuing significant regulations, calculated by those that have at least a $100 million economic impact, completing 89 by the end of 2022. The total added costs due to regulations on the economy are estimated to be $1.939 trillion.

Biden has made combating climate change a key part of his policy objectives, instituting and proposing a slew of environmental regulations that, if all approved, would ultimately add $9,166 in new costs for average Americans per home. Many of the regulations are targeted at ordinary household items like appliances, particularly gas furnaces, water heaters, air conditioners and more, in an attempt to reduce carbon emissions.

“The Fed is now keeping the money supply stable, which is why inflation is now under 4% instead of above 9%,” Young told the DCNF. “Raising interest rates has been part of that. The trouble is that has also raised rates on mortgages, car loans, small business loans and eaten away at people’s retirement savings and college funds. The trouble with inflation is that it hits everything.”

The average monthly payment for a car loan has increased from $617 in the third quarter of 2021 to $726 per month two years later, according to Experian. The combination of price increases and rising rates has led to an estimated half of Americans being priced out of the car market completely.

- Concerned about your life’s savings as the multiple challenges decimate retirement accounts? You’re not alone. Find out how Genesis Precious Metals can help you secure your wealth with a proper self-directed IRA backed by physical precious metals.

As a result of rising prices, Americans are spending through their savings, only holding a collective $768.6 billion in October. Comparatively, Americans held over $1 trillion in savings in May and nearly $6 trillion in April 2020.

“Long story short, inflation hits everything equally,” Young told the DCNF. “It’s a universal regressive tax. It hurts low-income families more because they have less room in their budgets to spare. Low-income families are also less likely to have interest-earning investments to help offset inflation.”

The White House did not respond to a request to comment from the DCNF.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].

Five Things New “Preppers” Forget When Getting Ready for Bad Times Ahead

The preparedness community is growing faster than it has in decades. Even during peak times such as Y2K, the economic downturn of 2008, and Covid, the vast majority of Americans made sure they had plenty of toilet paper but didn’t really stockpile anything else.

Things have changed. There’s a growing anxiety in this presidential election year that has prompted more Americans to get prepared for crazy events in the future. Some of it is being driven by fearmongers, but there are valid concerns with the economy, food supply, pharmaceuticals, the energy grid, and mass rioting that have pushed average Americans into “prepper” mode.

There are degrees of preparedness. One does not have to be a full-blown “doomsday prepper” living off-grid in a secure Montana bunker in order to be ahead of the curve. In many ways, preparedness isn’t about being able to perfectly handle every conceivable situation. It’s about being less dependent on government for as long as possible. Those who have proper “preps” will not be waiting for FEMA to distribute emergency supplies to the desperate masses.

Below are five things people new to preparedness (and sometimes even those with experience) often forget as they get ready. All five are common sense notions that do not rely on doomsday in order to be useful. It may be nice to own a tank during the apocalypse but there’s not much you can do with it until things get really crazy. The recommendations below can have places in the lives of average Americans whether doomsday comes or not.

Note: The information provided by this publication or any related communications is for informational purposes only and should not be considered as financial advice. We do not provide personalized investment, financial, or legal advice.

Secured Wealth

Whether in the bank or held in a retirement account, most Americans feel that their life’s savings is relatively secure. At least they did until the last couple of years when de-banking, geopolitical turmoil, and the threat of Central Bank Digital Currencies reared their ugly heads.

It behooves Americans to diversify their holdings. If there’s a triggering event or series of events that cripple the financial systems or devalue the U.S. Dollar, wealth can evaporate quickly. To hedge against potential turmoil, many Americans are looking in two directions: Crypto and physical precious metals.

There are huge advantages to cryptocurrencies, but there are also inherent risks because “virtual” money can become challenging to spend. Add in the push by central banks and governments to regulate or even replace cryptocurrencies with their own versions they control and the risks amplify. There’s nothing wrong with cryptocurrencies today but things can change rapidly.

As for physical precious metals, many Americans pay cash to keep plenty on hand in their safe. Rolling over or transferring retirement accounts into self-directed IRAs is also a popular option, but there are caveats. It can often take weeks or even months to get the gold and silver shipped if the owner chooses to close their account. This is why Genesis Gold Group stands out. Their relationship with the depositories allows for rapid closure and shipping, often in less than 10 days from the time the account holder makes their move. This can come in handy if things appear to be heading south.

Lots of Potable Water

One of the biggest shocks that hit new preppers is understanding how much potable water they need in order to survive. Experts claim one gallon of water per person per day is necessary. Even the most conservative estimates put it at over half-a-gallon. That means that for a family of four, they’ll need around 120 gallons of water to survive for a month if the taps turn off and the stores empty out.

Being near a fresh water source, whether it’s a river, lake, or well, is a best practice among experienced preppers. It’s necessary to have a water filter as well, even if the taps are still working. Many refuse to drink tap water even when there is no emergency. Berkey was our previous favorite but they’re under attack from regulators so the Alexapure systems are solid replacements.

For those in the city or away from fresh water sources, storage is the best option. This can be challenging because proper water storage containers take up a lot of room and are difficult to move if the need arises. For “bug in” situations, having a larger container that stores hundreds or even thousands of gallons is better than stacking 1-5 gallon containers. Unfortunately, they won’t be easily transportable and they can cost a lot to install.

Water is critical. If chaos erupts and water infrastructure is compromised, having a large backup supply can be lifesaving.

Pharmaceuticals and Medical Supplies

There are multiple threats specific to the medical supply chain. With Chinese and Indian imports accounting for over 90% of pharmaceutical ingredients in the United States, deteriorating relations could make it impossible to get the medicines and antibiotics many of us need.

Stocking up many prescription medications can be hard. Doctors generally do not like to prescribe large batches of drugs even if they are shelf-stable for extended periods of time. It is a best practice to ask your doctor if they can prescribe a larger amount. Today, some are sympathetic to concerns about pharmacies running out or becoming inaccessible. Tell them your concerns. It’s worth a shot. The worst they can do is say no.

If your doctor is unwilling to help you stock up on medicines, then Jase Medical is a good alternative. Through telehealth, they can prescribe daily meds or antibiotics that are shipped to your door. As proponents of medical freedom, they empathize with those who want to have enough medical supplies on hand in case things go wrong.

Energy Sources

The vast majority of Americans are locked into the grid. This has proven to be a massive liability when the grid goes down. Unfortunately, there are no inexpensive remedies.

Those living off-grid had to either spend a lot of money or effort (or both) to get their alternative energy sources like solar set up. For those who do not want to go so far, it’s still a best practice to have backup power sources. Diesel generators and portable solar panels are the two most popular, and while they’re not inexpensive they are not out of reach of most Americans who are concerned about being without power for extended periods of time.

Natural gas is another necessity for many, but that’s far more challenging to replace. Having alternatives for heating and cooking that can be powered if gas and electric grids go down is important. Have a backup for items that require power such as manual can openers. If you’re stuck eating canned foods for a while and all you have is an electric opener, you’ll have problems.

Don’t Forget the Protein

When most think about “prepping,” they think about their food supply. More Americans are turning to gardening and homesteading as ways to produce their own food. Others are working with local farmers and ranchers to purchase directly from the sources. This is a good idea whether doomsday comes or not, but it’s particularly important if the food supply chain is broken.

Most grocery stores have about one to two weeks worth of food, as do most American households. Grocers rely heavily on truckers to receive their ongoing shipments. In a crisis, the current process can fail. It behooves Americans for multiple reasons to localize their food purchases as much as possible.

Long-term storage is another popular option. Canned foods, MREs, and freeze dried meals are selling out quickly even as prices rise. But one component that is conspicuously absent in shelf-stable food is high-quality protein. Most survival food companies offer low quality “protein buckets” or cans of meat, but they are often barely edible.

Prepper All-Naturals offers premium cuts of steak that have been cooked sous vide and freeze dried to give them a 25-year shelf life. They offer Ribeye, NY Strip, and Tenderloin among others.

Having buckets of beans and rice is a good start, but keeping a solid supply of high-quality protein isn’t just healthier. It can help a family maintain normalcy through crises.

Prepare Without Fear

With all the challenges we face as Americans today, it can be emotionally draining. Citizens are scared and there’s nothing irrational about their concerns. Being prepared and making lifestyle changes to secure necessities can go a long way toward overcoming the fears that plague us. We should hope and pray for the best but prepare for the worst. And if the worst does come, then knowing we did what we could to be ready for it will help us face those challenges with confidence.

Articles like this are sooo 1950s and ultra–silly: Manchurian Joe and the regime pulling his puppet strings are hellbent in ENDING AMERICA, destroying all sectors beginning with the energy sector and all else, along with ALL public safety and national security!

In the short run, bringing in millions of ILLEGALS will collapse wages, destroy the housing market, overwhelm social and medical services, etc. — — — in the long run, defund citizenship and annihilate national idemtity!

All this parsing CUHRAP is just that, intended to confuse and bewilder – have no use for this writer!

When someone is nuking us, taking time out to describe windage and velocity is INFINITELY SILLY!

“Experts”????

The director of the Center for American Prosperity is Jim Carter, who was with the George Weasel Bush Administration, that member of the pro–CCP Bush family who ENDORSED Manchurian Joe TransBiden for the presidency!

What was the first action taken by the Bush Administration AFTER the attacks on 9/11???

They disbursed funds to chambers of commerce across America to host seminars on the most efficient manner for local corporations to OFFSHORE AMERICAN JOBS, thereby further dismantling the economy!

Those are your experts!

Reminds me of Bill Gates’ unscheduled layoff of 1,000 employees and contractors in Redmond on 9/12/01, taking advantage of all the media attention focused on the horrific attacks and 3,000 plus deaths! First I read about those Redmond layoffs was over a year later in the Puget Sound Business Journal, although I did hear about it earlier from several of the laid off workers!