The world’s largest asset manager and a leading investment index provider are facing congressional probes for allegedly facilitating the flow of U.S. dollars into Chinese companies that the United States has deemed to be fueling China’s military or the regime’s human rights abuses.

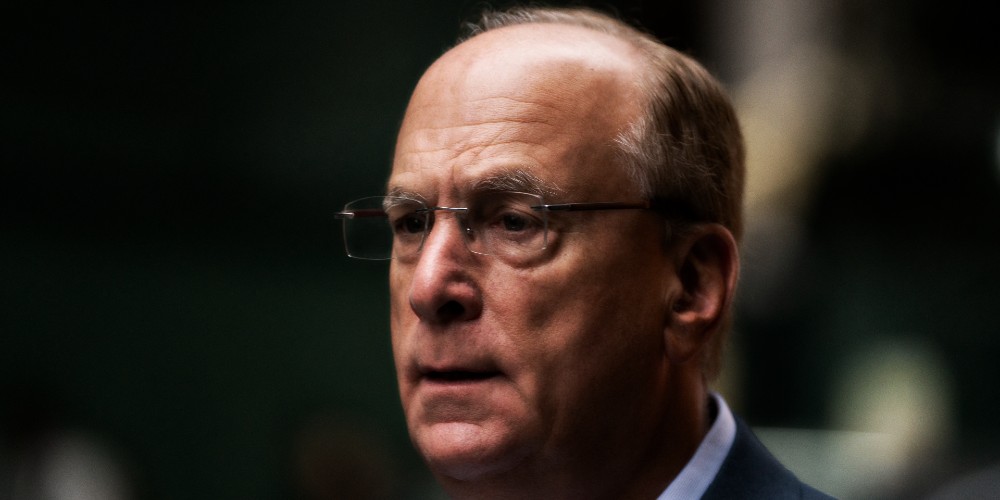

In letters dated July 31 to BlackRock CEO Larry Fink and MSCI head Henry Fernandez, the U.S. House’s China Select Committee stated that a brief review of MSCI indexes and BlackRock funds showed that the two companies together have directed investments to more than 60 Chinese entities already on the U.S. blacklist.

As a “direct result” of BlackRock’s and MSCI’s decisions, Americans who invested savings in their funds are now “unwittingly funding” Chinese companies that build weapons for the Chinese military known as the People’s Liberation Army, giving a hand to “the CCP’s stated mission of technological supremacy,” Rep. Mike Gallagher (R-Wis.), the committee’s chairman, and Rep. Raja Krishnamoorthi (D-Ill.), the ranking Democrat, wrote.

“It is unconscionable for any U.S. company to profit from investments that fuel the military advancement of America’s foremost foreign adversary and facilitate human rights abuses,” the lawmakers wrote, adding that the “massive flows of American capital” to these entities are “exacerbating an already significant national security threat and undermining American values.”

In the case of BlackRock, across five funds alone, the asset manager has invested more than $429 million in flagged Chinese firms, while nearly 5 percent of the MSCI China A Index is pegged to blacklisted entities. Such numbers, the lawmakers suspect, are only the tip of the iceberg.

The probe makes up part of the committee’s ongoing investigation into U.S. investments in China, which, in July, included venture capital firms that have invested in China-based artificial intelligence, semiconductor, and quantum companies.

A tough stance on China is one of the few issues that garner support from both political sides in the deeply divided Congress. The bipartisan House panel, formed in January, makes policy recommendations and has subpoena power, which Mr. Gallagher has said he would use if executives fail to cooperate with the committee probes.

“Both Democrats and Republicans can agree that we should not be funding PLA military modernization, supporting the CCP’s techno-totalitarian surveillance state, nor the CCP’s gross human rights abuses,” a source close to the committee told The Epoch Times.

MSCI has more than $13 trillion benchmarked to its products, making it one of the largest index providers globally. BlackRock oversees more than $9 trillion in assets, and is responsible to millions of U.S. investors who depend on its services for their future retirement.

BlackRock told The Epoch Times in a statement that it “complies with all applicable U.S. government laws” with “all investments in China and markets around the world,” and will continue to engage with the committee on the issues raised.

“Like many global asset managers, BlackRock offers our clients a number of strategies to invest in or exclude China from their portfolios. The majority of our clients’ investments in China are through index funds, and we are one of 16 asset managers currently offering U.S. index funds investing in Chinese companies,” a company spokesperson said.

MSCI, similarly, said it’s reviewing the request for information from the lawmakers.

“MSCI indexes measure the performance of equity markets available to international investors, and comply with all applicable U.S. laws. MSCI does not manage or recommend or facilitate investments in any country,” an MSCI spokesperson told The Epoch Times.

The Chinese entities on MSCI indexes include state-owned aerospace firm Aviation Industry Corp. China, which makes aircraft for the Chinese military; BGI Genomics, a military-linked Chinese genetics giant that the United States has found complicit in supporting forced labor; and ZTE, whose telecom equipment the United States banned last year, citing national security risks.

- Concerned about your life’s savings as the multiple challenges decimate retirement accounts? You’re not alone. Find out how Genesis Precious Metals can help you secure your wealth with a proper self-directed IRA backed by physical precious metals.

BlackRock, meanwhile, has funded a major subsidiary of China General Nuclear Power Group that the U.S. authorities accused of stealing U.S. nuclear technology, as well as that of China North Industries Group Co., producer of artillery shells and munitions for the Chinese military.

The lawmakers said they want to see a list of all the companies on MSCI indexes, as well as the thinking behind their inclusion, policies, and guidance documents relating to conflicts of interest that BlackRock has applied when engaging with China-linked entities, and details of U.S. investor exposure.

Article cross-posted from our premium news partners at The Epoch Times.

What Would You Do If Pharmacies Couldn’t Provide You With Crucial Medications or Antibiotics?

The medication supply chain from China and India is more fragile than ever since Covid. The US is not equipped to handle our pharmaceutical needs. We’ve already seen shortages with antibiotics and other medications in recent months and pharmaceutical challenges are becoming more frequent today.

Our partners at Jase Medical offer a simple solution for Americans to be prepared in case things go south. Their “Jase Case” gives Americans emergency antibiotics they can store away while their “Jase Daily” offers a wide array of prescription drugs to treat the ailments most common to Americans.

They do this through a process that embraces medical freedom. Their secure online form allows board-certified physicians to prescribe the needed drugs. They are then delivered directly to the customer from their pharmacy network. The physicians are available to answer treatment related questions.

Of course, that is the way the system is set up and constructed!

“Americans who invested savings in their funds are now “ ̶u̶n̶w̶i̶t̶t̶i̶n̶g̶l̶y̶ knowingly funding” Chinese companies that build weapons for the Chinese military . . .”

All investment — including MAJOR tax write-offs, funds it! When VP Joe Biden signed the MOU, or Memorandum of Understanding, with Xi Jinping, it was so that sketchy Chicom corporations could list on Wall Street with NO VETTING or standard auditing —- mystery communist corporations?!

Why??? Because Chicom companies do not sell stock shares —- illegal to sell to non–commies and foreigners, according to their laws and constitution! So it is VIEs offshore, or Variable Interest Entities, which are units of interest in the shares —- NOT the shares themselves, which can be closed overnight with tremendous losses —- all handled via offshore hedge funds. This took place several years ago with JPMorgan Chase and some other banks losing over $10 billion —- so what, they just take a major tax write-off, so those funds went to tne CCP, the Amercan tax base recapitalizes the banks, so the AMERICAN TAX BASE indirectly funds China’s military, their PLA (really directly, of course)!

The Private Equity/LBO standard model —— using, really depleting, the tax base for mass profit —— why the national debt correlates on a one—to—one basis with American billionaires —— they aren’t creating wealth, they are depleting it as it is shifted elsewhere! Each time a job is offshored, the American tax base is being dismantled, ditto for all such VIEs (and other) investments!

(In actuality, China owes American bondholders far more than the American gov’t owes China (see Andrew Hale’s articles at Heritage Foundation site)!)

Companies never lose $$$$$ — they make a fortune from tax write‐offs and tax breaks —- the tax structure purposely designed so! When Bill Gates, Sr., shyster father of Bill Gates, urged for changes in “inheritance tax” laws, the dude wasn’t beimg benevolent, it was to churn more business for the family law firms (two or three existed at that time), as they will then create new machinations (like thst GRAT) to get around new tax laws! Difficult or abstract to grasp, but THAT is the way they roll!

Bill Gates’ Gates Foundation is actually a subset of this overall design: really structured as a super—investment firm/financial influencer! First his Cascade Investments, or using another financial entity, he invests in the stocks and bonds of targeted corporations —– next his Gates Foundation “donates” to the corporation which is legal when the company states it is involved in a “charitable process” of some kind (???), either driving up the value of his existing shares and bonds, and/or he is part or full owner of the corporation so he is actually investing in it —- his “donation” constitutes a tax write–off, so a double or triple payout to Gates. (Sometimes a simple straight‐out investment: investing $50 million in Pfizer and cashing out $500 million later, but assured to happen as his Gates Foundation pays the salaries of 20 to 30 senior managers at the WHO, insuring the Pfizer spikevax will be promoted by them, etc. (He pays the salaries of senior types at the WHO, World Bank and elsewhere through a process known as SECONDMENTS!)

👍👍👍👍👍

Have enjoyed Ms. Fu’s articles in The Epoch Times frequently over the years!