But it’s not really like that. The days of massive turbulence appear to be behind us, especially with the election of crypto-loving President Donald Trump. His early moves to outlaw Central Bank Digital Currencies and to build a cabinet of crypto-aficionados has kept most currencies in a relatively steady state.

Bitcoin, for example, skyrocketed shortly after his election and has remained in a stable range ever since. There have been ups and downs, but at a rate similar to other investments like precious metals or the stock market.

This is why many Americans are looking into cryptocurrencies to back their retirement with a BlockTrust IRA. The potential upside is tremendous and with a more solid foundation with the Trump administration at the helm, fears have been mostly suppressed.

But that doesn’t mean there aren’t challenges. There’s a distinct learning curve. Then, there’s the question of whether it’s best to go with a buy-and-hold strategy or a managed account in which experts try to maximize returns while subverting tax burdens.

With BlockTrust IRA, the choices are wide open. Whether with cash or by rolling over or transferring an existing retirement account, clients of BlockTrust IRA have the flexibility to guide their wealth themselves or allow experts to manage their accounts with the assistance of AI-derived data analysis.

Reach out to BlockTrust IRA today. Create a free, no obligation account. Then learn if now is the time to advance your wealth into a bright future with cryptocurrencies.

]]>“Unless something strange happens, such as President Trump suddenly abandoning tariffs or BRICS shockingly reversing on de-dollarization, then it’s not too late to get in,” he said. “I’m always conservative with my price projections but every single indicator points to precious metals prices continuing to rise.”

Recent pushes by the Department of Government Efficiency to audit Fort Knox have added to speculation that a “revaluation” of gold and silver may be on the horizon. In the unlikely event that this happens, prices would skyrocket in an effort to buy down the national debt.

“It would be absolutely insane if that happened, but it’s not without precedent,” Rose said. “Personally, I don’t expect it but obviously it would be a big benefit for our clients if it did.”

The real value, according to Rose, is for physical precious metals to act as “safe haven” investments in an ever-changing geopolitical atmosphere.

This is how Genesis Gold Group positions its clients. With long-term projections playing the biggest role in determining how Genesis makes recommendations for their clients, they have the benefit of not chasing the news cycle. Their Genesis Gold IRA products are designed to help Americans defend and even grow their retirement accounts in the long-term while not missing out on short-term gains.

As a faith-driven company, they hold financial stewardship in high regard.

“I always say you don’t wait to buy gold, you buy gold and wait,” Rose said. “We are steady and studious on behalf of our clients which gives us, and them, a huge advantage over the fly-by-night pressure cooker gold outfits buzzing through the market today.”

Request a free, definitive Wealth Protection Kit today.

]]>The Grid Doctor 300 utilizes the latest technology to charge your electric appliances and digital devices in a fraction of the time that standard chargers take. Discharge and charge to 100% over 2,000 times.

Thanks to pass-thru charging, there’s no need to wait for a full battery. Charge the generator while you use it to power your electric appliances and digital devices! This uninterrupted power supply allows you to keep essential electronics operational at all times.

There are ENDLESS ways to plunge your world into darkness.

That’s why the Grid Doctor 300 solar generator with one FREE 100W solar panel included should be #1 on your survival checklist. It gives you what you’ve always wanted from solar generators, but never got from other brands:

- Lasts longer and runs stronger than other generators by connecting to TWO solar panels at once for up to 200W of charging power from the sun (second panel sold separately).

- The latest tech like Maximum Power Point Tracking, pass-through charging, and more.

- Nearly universal charging: No device left behind.

- Ease of use for all, from kids to grandparents.

Get your Grid Doctor 300 today!

]]>This is why central banks continue to buy at record paces in 2025. It’s why China, Russia, and Great Britain are scrambling to secure gold to meet the increasing demand. And it’s why savvy Americans are looking to physical precious metals to back their retirement accounts.

For years, gold companies have used scare tactics and unscrupulous enticements like “free” or “bonus” silver to lure Americans into their clutches. One faith-driven precious metals company has stayed squarely away from such tactics. Genesis Gold Group believes that financial stewardship and Biblical stewardship go hand-in-hand.

In lieu of listing all of the various reasons that Americans should consider a tax-free rollover or transfer of their current IRA, 401(k), or other retirement accounts, let’s stipulate that many have already come to the realization that physical precious metals make sense. The real question is who can facilitate the move as honorably and hassle-free as possible.

That would be Genesis Gold Group. They do not believe in a one-size-fits-all approach to your retirement. They learn the goals and intentions of their clients before putting together an appropriate mix of precious metals for their accounts.

Moreover, they build their “metals mix” from a diverse offering of precious metals products. This is important because it allows for maximum flexibility that their clients can enjoy.

Life moves quickly whether we want it to or not. Having a Genesis Gold IRA delivers the peace of mind that allows Americans to never have to stress over their retirement accounts, which often represent their life’s savings. Working with a faith-driven company that is powered by experts in the field makes perfect sense.

Request a free, definitive Wealth Protection Kit from Genesis Gold Group today.

]]>

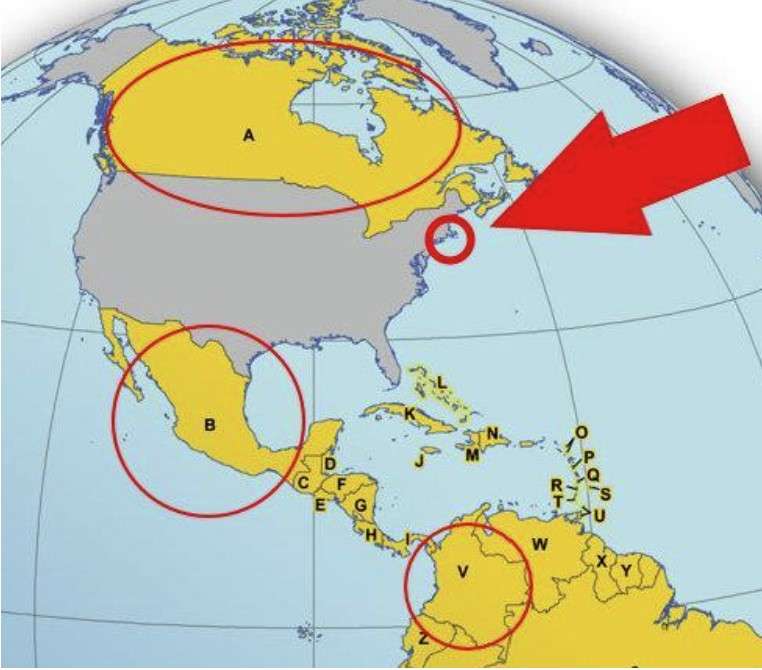

Canada… Mexico… Colombia…

Trump defeated them all with tariffs

But one ex-CIA analyst warns America’s biggest threat sits right in the heart of New York City…

He’s proven an event is already in motion…

With the power to crash the market by 20% in just a few minutes…

Immediately followed by a SECOND 20% crash.

Even worse, this new kind of crash is so powerful — it can even wipe out your savings account.

This expert wrote a 159 page analysis of the event that causes this crash where he show…

-

How it’s *already in progress*…

-

Why this new kind of crash requires a new kind of protection strategy…

-

And how to potentially profit using a strategy with an 88% win rate for 10 years running.

See his analysis here, but do not wait.

The catalyst for this event will appear as early as April 11th.

Prepare yourself and your family…

Or watch helplessly as the sky comes crashing down as soon as April 11th.

I recommend you click here immediately.

]]>Three policies stand out regarding IRAs, 401(k)s, and other types of retirement savings. Arguably the most important of these, which has been hot in the news recently, is the President’s use of tariffs. They are important staples of the President’s long- and short-term plans as he wields tariffs for negotiating as well as balancing trade relationships.

Tariffs also increase government revenues with President Trump longing for the days when tariffs can partially or even fully replace the income tax. This has helped prices of physical precious metals like gold and silver rise to record highs recently.

“President Trump loves tariffs and so do gold and silver prices,” said Jonathan Rose, CEO of faith-driven Genesis Gold Group. “We had more calls after the steel and aluminum tariffs were announced than after any other event during his second term so far.”

The second big economic policy that will impact retirement accounts is President Trump’s desire to weaken the U.S. Dollar. A strong dollar hurts manufacturing in the United States. The President wants an America First mindset to stream through American businesses and needs a weakened dollar to facilitate that.

“We have currency problems, as you know, the depth of the currency now in terms of strong dollar/weak yen, weak yuan, is massive,” President Trump said. “And I used to fight them, you know, they wanted it weak all the time. They would fight it, and I said, if you weaken it any more, I’m going to have to put tariffs on you. They went as far as they could with me, but I was very tough with it. Nobody talks about it now.”

His sentiment in his first term is echoed in his second. If anything, he is even more focused on weakening the dollar. How will this affect IRAs and 401(k)s?

“Like with tariffs, a weak dollar favors gold and silver over other ways to back retirement accounts,” Rose continued. “This is why we’ve positioned our ‘metals mix’ to help our clients take full advantage of President Trump’s fiscal policies.”

The third part of President Trump’s economic policy is mostly out of his hands. He wants interest rates lowered, as he noted recently on Truth Social.

“Interest Rates should be lowered, something which would go hand in hand with upcoming Tariffs!!! ” he posted. “Lets Rock and Roll, America!!!”

Lowered interest rates will likely help gold and silver prices rise as well. With Fed Chair Jerome Powell signaling an unwillingness to do so right now, it leaves a potential upside for precious metals prices that won’t be realized just yet.

If and when the Fed drops rates, those holding precious metals in their retirement account will be further rewarded.

A Genesis Gold IRA is ideal for the long-term play for retirements. Learn more about them today and receive a free, definitive Wealth Protection Guide.

]]>Concerns have only become more prevalent in 2025 with bird flu hitting, decimating herds and making ranchers more desperate than they already were.

Between rising food prices, “climate change” gaslighting, post-election leftist outrage, and an obsessive effort by governments and globalist entities to eliminate real meat from our diets, beef is poised to be extremely valuable in the years and even months to come.

Of particular value will be shelf-stable beef. Whether it’s canned, dehydrated, or freeze-dried, having beef that is still safe and nutritious for years is piquing the interests of people across the country. It isn’t just the “doomsday preppers” who are concerned. The last four years have caused tremendous anxiety to be felt by Americans, and for very logical reasons.

We have a special partnership with Prepper All Naturals. We (and you) benefit when you use promo code “jdr” at checkout for 35% off.

When Prepper All Naturals launched in 2022, their initial focus was on chicken. They always knew beef would be part of their future but at the time it was chicken that was more easily accessible. That changed very quickly in the beginning of 2023 when “theoretical” discussions of replacing beef with lab-grown “meat” or bugs began manifesting ubiquitously in the real world.

The powers-that-be stopped talking about it as the future and started referring to it as a current initiative.

Unfortunately, this is not something that we can easily prevent. Politicians are already threatening limits or even complete bans on beef. State, local, and foreign governments are imposing draconian regulations on beef providers as well as the processing plants that service them. An insider at the Texas and Southwestern Cattle Raisers Association warned us privately that costs are going to start shooting up across the board by mid-2025.

The war on meat is happening even if most Americans have no idea. Corporate media won’t be allowed to report on it until it’s too late.

Beef from Prepper All Naturals is the only freeze-dried beef product in America that doesn’t try to push “beef crumbles” or low-quality “beef chunks” onto consumers. They offer sous vide, freeze-dried Ribeye, NY Strip, Tenderloin, and their “Original Steak” product that is made up of Sirloin, Chuck, and other premium cuts. Even their lowest priced item is far superior to everything else in the market.

They are now offering chicken as well.

“Anyone who’s ever tried to eat freeze-dried ‘beef crumbles’ will never buy a bag of it again,” said Jason Nelson, co-founder of Prepper All Naturals. “The low-quality parts of our cattle are sold to wholesalers after slaughter and, ironically, end up being purchased by other survival companies. We only offer the good stuff to our customers.”

Since beef is the only ingredient in a bag of Sous Vide Beef Cubes, they remain shelf-stable for up to 25-years. This is one of the reasons freeze-dried beef is so much more valuable than canned or dehydrated beef that last for 1-3 years.

Another reason is the nutritional retention. Each bag has 12 adult-sized servings with over 20 grams of protein. Freeze-drying is the only food longevity process for beef that allows it to retain full nutritional values for over a decade.

Last but not least, the push to inject cattle with mRNA vaccines is ongoing. Just as they did with pork, it seems inevitable that beef will be tainted by near-future mandates. Nelson has vowed to never sell beef that has had mRNA vaccines once they begin rolling out.

“We had a customer last year who purchased hundreds of bags in a one-week period,” Nelson said. “We contact him and learned that he plans on feeding his family but also believes these bags will be tremendous for barter should there be a major change in society.

“As he put it, it will be a matter of negotiating to determine how many bags he’ll need to trade for a truck when the crap really hits the fan.”

If there is such a societal collapse, it is very likely that long-term storage beef will be extremely valuable. But one does not have to wait for the apocalypse to appreciate having high-quality beef on hand if prices continue skyrocketing. Even if things get incrementally better with everything else, beef is still going to be targeted.

Stock up now at Prepper All Naturals. Use promo code “jdr” for 35% off at checkout.

]]>There are two challenges that Americans face in getting into cryptocurrencies. First, there’s a steep learning curve. It’s not as simple as just investing in a popular stock or buying precious metals. Second, it often requires a great deal of cash on hand to make it a real game changer.

Both challenges have now been alleviated with a BlockTrust IRA. The team of experienced blockchain experts manage accounts in ways that allow even novices to invest like pros. The award-winning system that drives their decisions was, until very recently, only available to hedge funds… and they’re STILL using it because it works. The only difference is that today it’s open to everyone.

This makes BlockTrust IRA ideal for anyone, whether they’re new to crypto or seasoned investors.

The other challenge has been overcome by the addition of IRA experts and unique relationships with financial institutions that have been built as a result. Those who want to buy with cash certainly can take advantage of the system. Those who want to do a tax-free rollover or transfer of their retirement accounts can take advantage of BlockTrust IRA without paying a ton out of pocket.

Between tariffs, de-dollarization, and market fluctuations, it’s crystal clear what direction President Trump is taking the economy. By banning Central Bank Digital Currencies, he made sure that the way is paved for America to be the leaders in the cryptocurrency revolution.

With BlockTrust IRA, Americans can be part of this revolution even if they aren’t Bitcoin Millionaires already.

Learn more by opening a free account today at BlockTrust IRA.

]]>“Any steel coming into the United States is going to have a 25 percent tariff,” he told reporters on Feb. 9 on Air Force One as he flew from Florida to New Orleans to attend the Super Bowl. When asked about aluminum, he told reporters that it will also be subject to the trade penalties.

Gold and silver set fresh records on skyrocketing prices and demand. Big banks and financial institutions immediately started buying on news of the first real indicator of a protracted and aggressive trade policy.

President Trump’s initial forays into tariffs were over quickly after both Canada and Mexico caved to his demands before the deadline. This one is different. It is more about protectionism and revenue generation which signals that these tariffs are here to stay.

Trump also told reporters that he would soon announce “reciprocal tariffs” on Feb. 11 or Feb. 12, meaning that the United States could impose duties on products from countries that have placed tariffs on U.S. goods.

“If they are charging us 130 percent and we’re charging them nothing, it’s not going to stay that way,” he told reporters.

Jonathan Rose, CEO of Genesis Gold Group, has been preparing his company and his clients for this move since before the presidential election.

“We adjusted our ‘metals mix’ to help new clients be best prepared for this inevitability,” he said. “This has allowed us to avoid the ‘scare tactics’ and focus on truly protecting our clients’ wealth and retirement.

“The writing was on the wall for a while but most precious metals companies have stuck with gimmicks like ‘free’ or ‘bonus’ silver instead of doing what’s actually beneficial for their clients.”

According to the U.S. Department of Commerce, the European Union levies as much as 50 percent tariffs on motorcycles and 10 percent on automobiles, while India places 60 percent duties on U.S. cars and hefty tariffs on agricultural products.

During the campaign, Trump often said that he would place tariffs on a variety of goods and countries, sometimes even suggesting that the United States could abolish the income tax in favor of tariffs.

Gold prices have been projected to break $3,000 per ounce this year. With a trade war brewing, they may actually break that barrier this month.

“This is exactly what we were anticipating,” Rose added. “If anything President Trump is moving even faster than we expected, which bodes well for those who roll over or transfer their retirement accounts soon.”

Genesis Gold Group is a faith-driven precious metals company that helps Americans protect their retirement with a Genesis Gold IRA. They are uniquely positioned to assist with tax-free moves into physical precious metals.

“Where a country … charges us so much, and we do the same,” President Trump said. “I think that’s the only fair way to do it. That way, nobody’s hurt.”

]]>One strategy gaining traction, especially with President Donald Trump back in the Oval Office, is the conversion of traditional retirement accounts into a Genesis Gold IRA. Here’s a look at what this entails and why it’s becoming a popular choice for many.

Understanding the Genesis Gold IRA

A Genesis Gold IRA is a specialized type of self-directed IRA that allows investors to hold physical gold, silver, or other precious metals as part of their retirement savings. Unlike conventional IRAs, which are typically invested in stocks, bonds, or mutual funds, a Genesis Gold IRA diversifies your portfolio with tangible assets that have historically retained value over time.

Those who want to roll over or transfer their retirement accounts can often do so tax-free. This is an important consideration that often gets overlooked until it’s too late.

Why Now? The Trump Effect

During President Trump’s first term, there was a notable push towards policies that could potentially impact the value of the dollar and inflation rates. That yielded a 51% increase in gold prices in his first four years.

Experts are predicting that gold and silver will rise even higher in his second term and the results are already manifesting.

Trade wars will very likely have their desired effects which will push precious metals higher. Then, there’s the challenge with inflation and interest rates.

“We’re in a position where there’s still inflation, and it’s sticky inflation,” Kevin Grady, president of Phoenix Futures and Options, said. “[Trump] has been in for two weeks, and he’s trying to address some of these concerns, but it takes a little time to get them done. But right now, I don’t see them being able to sustain a long-term rate-cut plan. And I see a lot of people looking at that.”

President Trump’s fiscal policies are designed to benefit those protect their wealth with physical precious metals. He proved that in his first term and he’s already showing it in his second term. This, perhaps more than anything else, is why both Wall Street and Main Street are becoming more bullish about the long-term prospects of gold and silver.

Protect Your Retirement Today

Genesis Gold Group is a faith-driven precious metals company that aligns itself with President Trump’s America First fiscal policies. Reach out to request a free, definitive gold guide that lays out the three-step process for protecting your retirement today.

]]>