(WND)—Lately, the mainstream media have been delicately tiptoeing around the possibility that America “might” be in a recession. In the height of irony, evidently the mainstream media aren’t paying attention to headlines:

All cheery news, right? But it was a short video I saw last week that really hit home. This video compared the costs of homes, rent and income between 1930 and 2023. For reasons that will become clear, this is being called the Great Depression vs. the Silent Depression.

“You’re in a Silent Depression,” says a man calling himself Wall Street Silver. “When you compare the Great Depression to today, this is absolutely going to blow your mind. In 1930 during the Great Depression, the average home in America was $3,900. The average car was $600. The average monthly rent was $18, or $216 a year, and the average salary was $1,300 a year. Fast forward to today. It is $436,000 for the average home, $48,000 for the average car, and the average rent is $2,000 a month, or $24,000 a year, and we have a $56,000 income for the average American right now.

“So if you look back to the Great Depression, the house was only three times the average salary. Now it is eight times the average salary. The car was 46% of the salary. The car today is 85% of the salary. And here’s the craziest part. The rent was 16% of the average salary. It is now 42% of the average salary.”

While I haven’t confirmed these numbers, I have no reason to question their accuracy. It explains so much about why people – especially the younger generations – can’t get ahead.

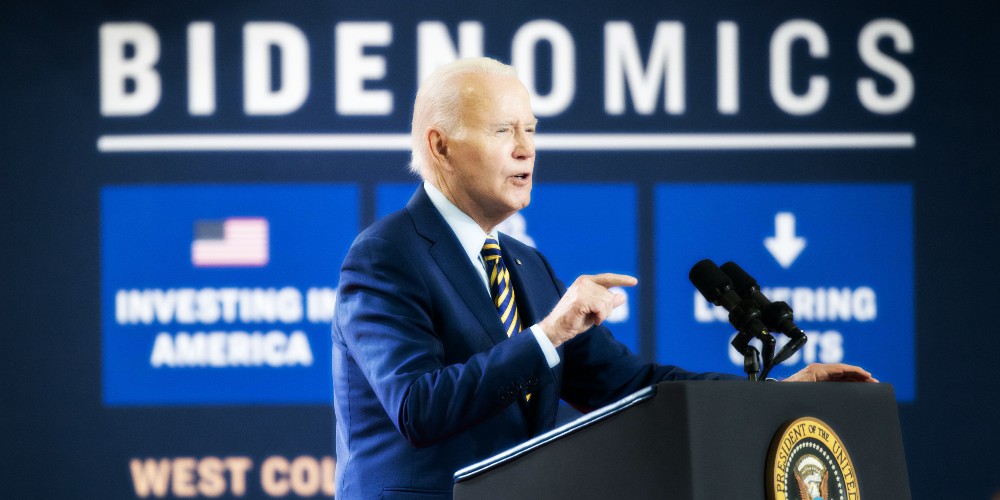

Article after article reinforces the notion that we’re actually in an economic depression right now; but because the far-left Biden administration is in power, it’s doing everything imaginable to keep from calling it that.

Coffee the Christian way: Promised Grounds

Forbes flat-out pooh-poohs the whole concept of a depression, even while admitting the fiscal reality for millions of people. “American households have incurred more than $1 trillion in credit card debt, tapped into their 401(k) retirement plans and many are unable to purchase a home as mortgage rates have soared past 7%,” writes senior Forbes contributor Jack Kelly. “Even with all of the current challenges, the standard of living remains far ahead of the dire circumstances of the Great Depression.”

I see. Because we have smartphones and fancier cars, it’s impossible for America to be in an economic depression? Kelly lists dire statistic after dire statistic – housing costs, health care costs, inflation, debt (including student loan debt), difficulties in finding (white collar) employment, salary cuts, underemployment – and then concludes “comparing it to the Great Depression is hyperbolic,” in part because the stock market hasn’t crashed, the Misery Index is still low, and “the U.S. has thus far been able to avoid recession.” Oh, and because “the current unemployment rate is 3.8%.” (Shadowstats, however, reports the current unemployment rate at 25%.)

From sociopolitical commentary to romance writing! Patrice Lewis branches into the world of Amish inspirational fiction. These clean romances are wholesome enough for Grandma to read. Check out Patrice’s available titles.

To Kelly’s credit, he does conclude his piece by admitting rising inequality “isn’t fully captured by statistics” and “a large segment of workers, especially Gen-Z, face depressed opportunities compared to prior generations despite headline growth.” [Emphasis added.]

Despite – or perhaps because of – all of Kelly’s fancy weasel words, his argument has failed to convince me the American economy is booming.

If we are in a depression, it behooves us to learn from the last one. I’ve often wondered if people knew in 1928 what would happen in 1929, what could they have done to brace themselves? In light of the current situation, I think that question is just as pertinent today. What is the best way to brace for a looming or current economic depression?

To answer this, I drew advice from a couple of pieces on the subject of “Lessons of the Great Depression” (here and here) and plucked out some pertinent concepts:

- Diversify everything from investments to skills (generalists and jacks-of-all-trades thrived).

- Fewer bad things happened to those who were debt-free.

- Need less and waste less. Get lean.

- Multiple income streams are better than one solitary stream, no matter how large.

- Wean yourself off dependency wherever possible, everything from addictions to government aid.

- Tangible investments are often better than intangible investments. Livestock and gardens reproduce.

- Band together whenever possible (family, neighbors, church) to help each other out. There is strength in numbers.

- Belief in a Higher Power was a massively sustaining force for when people were at their lowest.

- “The situation at hand had the final say.” People were forced to roll with the punches and adapt to their circumstances. No amount of anger, despair, or bargaining could change reality.

- Be generous. Personal circumstances can change in an instant.

- Always look for work. This doesn’t (necessarily) mean you’re working a second 40-hour-per-week job; but it does mean you’re taking advantage of side gigs or odd jobs that come your way. Even unpaid “work” has its merits, as it teaches you skills, develops your reputation and broadens your influence.

- The concept of “retirement” changed completely. People worked as long as they were able.

The Great Depression started with a dramatic bang – the stock market crash – but not every incident of economic turmoil begins like that. Many traumatic events begin with a whisper, which seems to be the case here. Whispers don’t make it any less painful for those affected, but it does make it more deniable by those with a political ax to grind.

Remember this: Politicians are not working in our (or America’s) best interests. If we are in a Silent Depression, we’re on our own to cope with the mess our “elected” officials created. Act accordingly.

Content created by the WND News Center is available for re-publication without charge to any eligible news publisher that can provide a large audience. For licensing opportunities of our original content, please contact [email protected].

Controlling Protein Is One of the Globalists’ Primary Goals

Between the globalists, corporate interests, and our own government, the food supply is being targeted from multiple angles. It isn’t just silly regulations and misguided subsidies driving natural foods away. Bird flu, sabotaged food processing plants, mysterious deaths of entire cattle herds, arson attacks, and an incessant push to make climate change the primary consideration for all things are combining for a perfect storm to exacerbate the ongoing food crisis.

The primary target is protein. Specifically, they’re going after beef as the environmental boogeyman. They want us eating vegetable-based proteins, lab-grown meat, or even bugs instead of anything that walked the pastures of America. This is why we launched a long-term storage prepper beef company that provides high-quality food that’s shelf-stable for up to 25-years.

At Prepper All-Naturals, we believe Americans should be eating real food today and into the future regardless of what the powers-that-be demand of us. We will never use lab-grown beef. We will never allow our cattle to be injected with mRNA vaccines. We will never bow to the draconian diktats of the climate change cult.

Visit Prepper All-Naturals and use promo code “veterans25” to get 25% off plus free shipping on Ribeye, NY Strip, Tenderloin, and other high-quality cuts of beef. It’s cooked sous vide, then freeze dried and packaged with no other ingredients, just beef. Stock up for the long haul today.