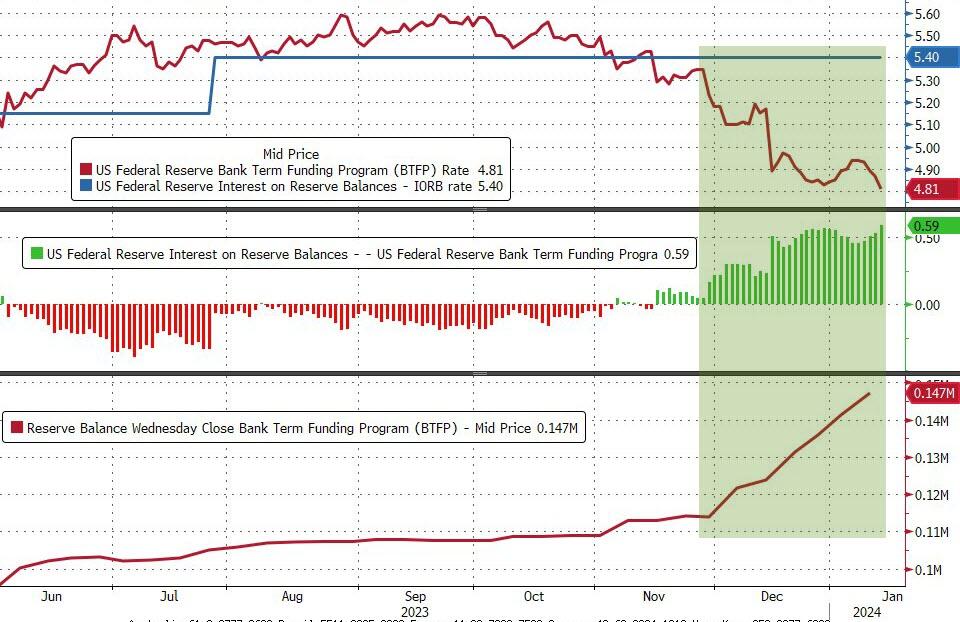

(Zero Hedge)—Bank reserves at The Fed rose considerably last week expanding The Fed’s balance sheet by the most since the SVB crisis last March – as usage of The Fed’s BTFP bank-bailout facility pushed to a new record high (amid increasing arbitrage flows).

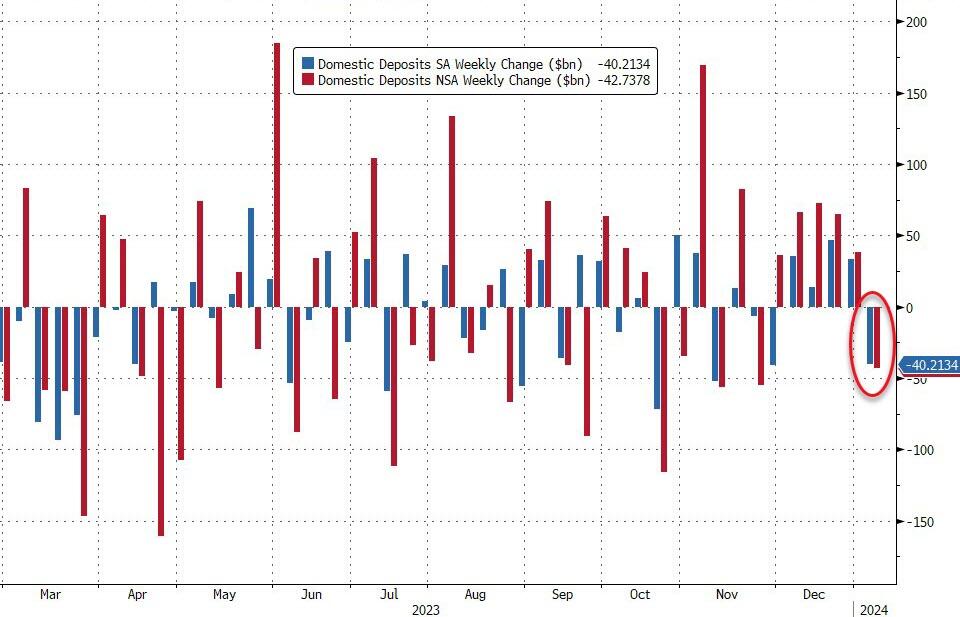

But, after four straight weeks of inflows, seasonally-adjusted bank deposits saw $23.3BN outflows in the first week of 2024…

And, on a non-seasonally-adjusted basis, deposits also saw an outflow (-$33.7BN) after five weeks in a row of inflows (NSA)…

Which means that while money-market funds hit a new record high, bank deposits did pull back a little (despite the drain in RRP filling the liquidity gap)…

Excluding foreign bank flows, domestic banks saw deposit outflows of just over $40BN (SA and NSA) – the first in 5 weeks…

Large banks dominated that deposit outflow (Large -$39.9BN, Small -$347MN)…

On the other side of the ledger, Large bank loan volumes tumbled (-$16.6BN) for the 5th week in row (small bank loan volume rose $4.3BN)…

The Fed’s reverse repo facility is draining fast (faster each week), getting closer and closer to zero…

…at which point reserves get yanked, which mean huge deposit flight.

And the embarrassing surge in usage of The Fed’s BTFP for free-money-arbitrage…

…will make it hard for The Fed to defend leaving the facility open after March when its “temporary” nature is supposed to expire.

“In justifying the generous terms of the original program, the Fed cited the ‘unusual and exigent’ market conditions facing the banking industry following last spring’s deposit runs,” Wrightson ICAP economist Lou Crandall wrote in a note to clients.

“It would be difficult to defend a renewal in today’s more normal environment.”

Which means, as we pointed out earlier in the week, “March will be lit”…

March will be lit:

1. Reverse repo ends

2. BTFP expires

3. Fed cuts (allegedly)

4. QT ends (allegedly)— zerohedge (@zerohedge) January 8, 2024

Because without the help of The Fed’s BTFP, the regional banking crisis is back bigly (red line), and large bank cash needs a home – green line – like picking up a small bank from the FDIC…

And now you know why The Fed will cut rates in March – no matter what jobs or inflation is doing.

What Would You Do If Pharmacies Couldn’t Provide You With Crucial Medications or Antibiotics?

The medication supply chain from China and India is more fragile than ever since Covid. The US is not equipped to handle our pharmaceutical needs. We’ve already seen shortages with antibiotics and other medications in recent months and pharmaceutical challenges are becoming more frequent today.

Our partners at Jase Medical offer a simple solution for Americans to be prepared in case things go south. Their “Jase Case” gives Americans emergency antibiotics they can store away while their “Jase Daily” offers a wide array of prescription drugs to treat the ailments most common to Americans.

They do this through a process that embraces medical freedom. Their secure online form allows board-certified physicians to prescribe the needed drugs. They are then delivered directly to the customer from their pharmacy network. The physicians are available to answer treatment related questions.

Reach out to Jase Medical today and use promo code “Rucker10” for $10 off your order.

Important: Our sponsors at Jase are now offering emergency preparedness subscription medications on top of the long-term storage antibiotics they offer. Use promo code “Rucker10” at checkout!