(Schiff Gold)—With a stunning trillion dollars added to the national debt in only three months, projected to reach an incomprehensible $54 trillion within 10 years, and America’s interest payments on track to exceed defense spending next year, the question must be asked: How much longer can the debt bubble go?

It’s a curious situation when Jerome Powell, a man who oversaw the largest money-printing campaign in American history, is saying that the debt is unsustainable. While maintaining that the Fed “tries hard not to comment on fiscal policy,” Powell’s suggestion for handling the debt shifts blame and burden from money printing to fiscal irresponsibility on the part of policymakers.

While they have their part to play, and it’s a big one, it’s interesting to see that Federal Reserve monetary policy hasn’t been mentioned in any of Powell’s ‘urgent’ warnings about ballooning debt:

“In the long run, the U.S. is on an unsustainable fiscal path. The U.S. federal government’s on an unsustainable fiscal path. And that just means that the debt is growing faster than the economy. So, it is unsustainable. I don’t think that’s at all controversial. And I think we know that we have to get back on a sustainable fiscal path.”

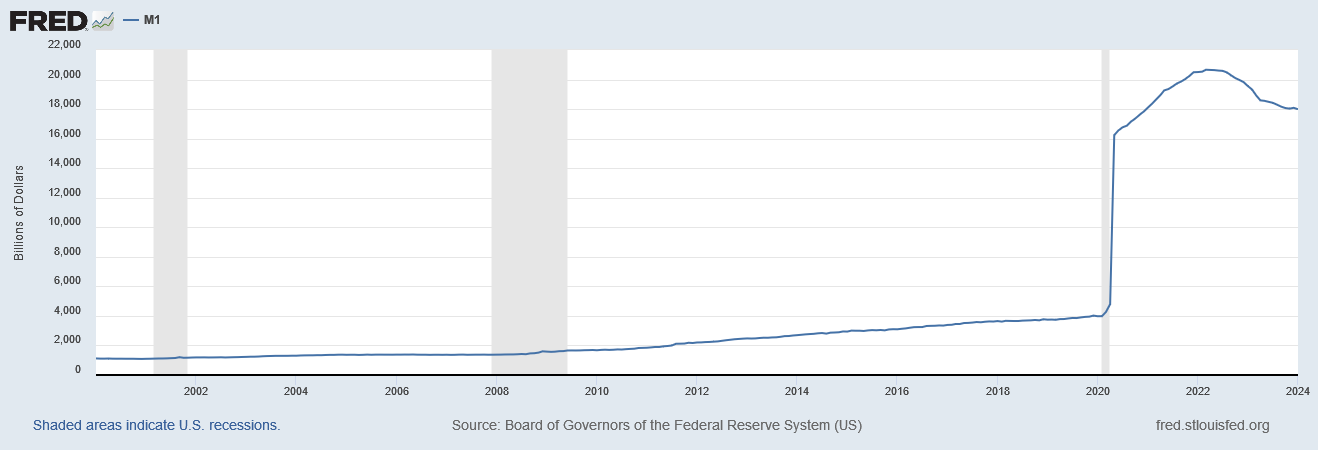

It’s a wonder how, even if the government suddenly adopted responsible spending and budgeting, we would be back on a path of true sustainability after Powell oversaw the printing of over 3 trillion dollars in 2020 alone. The Fed is an interesting source of criticism for unsustainable debt, to say the least:

More loans and more deposits will increase M1 in an already-frothy inflationary environment, adding pressure to a pot that’s already in danger of boiling over from money printing during Covid. Post-COVID rate hikes have not even come close to reversing this course, with interest still far lower than it would be in an actual free market, where a few dozen bureaucrats would no longer be pulling the levers. Excessive borrowing makes US Treasurys less attractive as doubts begin to mount that the US will be able to pay its obligations back, decreasing demand for our debt and fueling further challenges for funding the government.

All of this led Fitch and Moody’s to downgrade the US’s credit rating last year, from “AAA” to “AA+” in the case of Fitch, and for Moody’s, from “stable” to “negative.” Fed interest rate hikes without an accompanying plan to reduce spending or increase revenue leave no hope at all for meaningfully reducing fiscal deficits.

From this new sense of urgency, lawmakers in Idaho and Wyoming have called for a convention of states to address the problem, with Idaho’s resolutions calling for a possible constitutional amendment limiting the spending abilities and overall power of the federal government. Idaho’s Senate Concurrent Resolution 112, or SCR 112, calls for, in its words:

“(1) imposing fiscal restraints on the federal government; (2) limiting the power and jurisdiction of the federal government; and (3) limiting the terms in office for its officials and for members of Congress. Currently, identical applications have been sent to Congress by other state legislatures.”

The question remains if anything, at this point, would be enough to get the US back on a genuinely sustainable economic track other than an outright collapse of the US dollar leading to a total monetary reset. As long as the Fed exists, the likelihood of truly reigning in out-of-control debt is nothing but a pipe dream.

With recent new all-time highs for gold and bitcoin in response to the debasement of the debt and central banks locked in a buying spree that is likely to last years, the message is clear that the banking system agrees with Peter Schiff that inflation is far from over.

Survival Beef on sale now. Freeze dried Ribeye, NY Strip, and Premium beef cubes. Promo code “jdr” at checkout for 25% off! Prepper All-Naturals

Five Things New “Preppers” Forget When Getting Ready for Bad Times Ahead

The preparedness community is growing faster than it has in decades. Even during peak times such as Y2K, the economic downturn of 2008, and Covid, the vast majority of Americans made sure they had plenty of toilet paper but didn’t really stockpile anything else.

Things have changed. There’s a growing anxiety in this presidential election year that has prompted more Americans to get prepared for crazy events in the future. Some of it is being driven by fearmongers, but there are valid concerns with the economy, food supply, pharmaceuticals, the energy grid, and mass rioting that have pushed average Americans into “prepper” mode.

There are degrees of preparedness. One does not have to be a full-blown “doomsday prepper” living off-grid in a secure Montana bunker in order to be ahead of the curve. In many ways, preparedness isn’t about being able to perfectly handle every conceivable situation. It’s about being less dependent on government for as long as possible. Those who have proper “preps” will not be waiting for FEMA to distribute emergency supplies to the desperate masses.

Below are five things people new to preparedness (and sometimes even those with experience) often forget as they get ready. All five are common sense notions that do not rely on doomsday in order to be useful. It may be nice to own a tank during the apocalypse but there’s not much you can do with it until things get really crazy. The recommendations below can have places in the lives of average Americans whether doomsday comes or not.

Note: The information provided by this publication or any related communications is for informational purposes only and should not be considered as financial advice. We do not provide personalized investment, financial, or legal advice.

Secured Wealth

Whether in the bank or held in a retirement account, most Americans feel that their life’s savings is relatively secure. At least they did until the last couple of years when de-banking, geopolitical turmoil, and the threat of Central Bank Digital Currencies reared their ugly heads.

It behooves Americans to diversify their holdings. If there’s a triggering event or series of events that cripple the financial systems or devalue the U.S. Dollar, wealth can evaporate quickly. To hedge against potential turmoil, many Americans are looking in two directions: Crypto and physical precious metals.

There are huge advantages to cryptocurrencies, but there are also inherent risks because “virtual” money can become challenging to spend. Add in the push by central banks and governments to regulate or even replace cryptocurrencies with their own versions they control and the risks amplify. There’s nothing wrong with cryptocurrencies today but things can change rapidly.

As for physical precious metals, many Americans pay cash to keep plenty on hand in their safe. Rolling over or transferring retirement accounts into self-directed IRAs is also a popular option, but there are caveats. It can often take weeks or even months to get the gold and silver shipped if the owner chooses to close their account. This is why Genesis Gold Group stands out. Their relationship with the depositories allows for rapid closure and shipping, often in less than 10 days from the time the account holder makes their move. This can come in handy if things appear to be heading south.

Lots of Potable Water

One of the biggest shocks that hit new preppers is understanding how much potable water they need in order to survive. Experts claim one gallon of water per person per day is necessary. Even the most conservative estimates put it at over half-a-gallon. That means that for a family of four, they’ll need around 120 gallons of water to survive for a month if the taps turn off and the stores empty out.

Being near a fresh water source, whether it’s a river, lake, or well, is a best practice among experienced preppers. It’s necessary to have a water filter as well, even if the taps are still working. Many refuse to drink tap water even when there is no emergency. Berkey was our previous favorite but they’re under attack from regulators so the Alexapure systems are solid replacements.

For those in the city or away from fresh water sources, storage is the best option. This can be challenging because proper water storage containers take up a lot of room and are difficult to move if the need arises. For “bug in” situations, having a larger container that stores hundreds or even thousands of gallons is better than stacking 1-5 gallon containers. Unfortunately, they won’t be easily transportable and they can cost a lot to install.

Water is critical. If chaos erupts and water infrastructure is compromised, having a large backup supply can be lifesaving.

Pharmaceuticals and Medical Supplies

There are multiple threats specific to the medical supply chain. With Chinese and Indian imports accounting for over 90% of pharmaceutical ingredients in the United States, deteriorating relations could make it impossible to get the medicines and antibiotics many of us need.

Stocking up many prescription medications can be hard. Doctors generally do not like to prescribe large batches of drugs even if they are shelf-stable for extended periods of time. It is a best practice to ask your doctor if they can prescribe a larger amount. Today, some are sympathetic to concerns about pharmacies running out or becoming inaccessible. Tell them your concerns. It’s worth a shot. The worst they can do is say no.

If your doctor is unwilling to help you stock up on medicines, then Jase Medical is a good alternative. Through telehealth, they can prescribe daily meds or antibiotics that are shipped to your door. As proponents of medical freedom, they empathize with those who want to have enough medical supplies on hand in case things go wrong.

Energy Sources

The vast majority of Americans are locked into the grid. This has proven to be a massive liability when the grid goes down. Unfortunately, there are no inexpensive remedies.

Those living off-grid had to either spend a lot of money or effort (or both) to get their alternative energy sources like solar set up. For those who do not want to go so far, it’s still a best practice to have backup power sources. Diesel generators and portable solar panels are the two most popular, and while they’re not inexpensive they are not out of reach of most Americans who are concerned about being without power for extended periods of time.

Natural gas is another necessity for many, but that’s far more challenging to replace. Having alternatives for heating and cooking that can be powered if gas and electric grids go down is important. Have a backup for items that require power such as manual can openers. If you’re stuck eating canned foods for a while and all you have is an electric opener, you’ll have problems.

Don’t Forget the Protein

When most think about “prepping,” they think about their food supply. More Americans are turning to gardening and homesteading as ways to produce their own food. Others are working with local farmers and ranchers to purchase directly from the sources. This is a good idea whether doomsday comes or not, but it’s particularly important if the food supply chain is broken.

Most grocery stores have about one to two weeks worth of food, as do most American households. Grocers rely heavily on truckers to receive their ongoing shipments. In a crisis, the current process can fail. It behooves Americans for multiple reasons to localize their food purchases as much as possible.

Long-term storage is another popular option. Canned foods, MREs, and freeze dried meals are selling out quickly even as prices rise. But one component that is conspicuously absent in shelf-stable food is high-quality protein. Most survival food companies offer low quality “protein buckets” or cans of meat, but they are often barely edible.

Prepper All-Naturals offers premium cuts of steak that have been cooked sous vide and freeze dried to give them a 25-year shelf life. They offer Ribeye, NY Strip, and Tenderloin among others.

Having buckets of beans and rice is a good start, but keeping a solid supply of high-quality protein isn’t just healthier. It can help a family maintain normalcy through crises.

Prepare Without Fear

With all the challenges we face as Americans today, it can be emotionally draining. Citizens are scared and there’s nothing irrational about their concerns. Being prepared and making lifestyle changes to secure necessities can go a long way toward overcoming the fears that plague us. We should hope and pray for the best but prepare for the worst. And if the worst does come, then knowing we did what we could to be ready for it will help us face those challenges with confidence.

Important: Our sponsors at Jase are now offering emergency preparedness subscription medications on top of the long-term storage antibiotics they offer. Use promo code “Rucker10” at checkout!